PUBLIC

Everyday people have turned to retail trading at an extraordinary rate over the past year, drawn in by more accessible trading apps that promise free trades and a democratization of finance. With record numbers of people stuck at home during the pandemic, millions flocked to trading as a pastime and as a way to earn extra income if they fared well. The stock market debacle that has unfolded over the past weeks has drawn regulatory concern and raised questions over how free “free trades'' actually are. This brings us to the latest bit of fintech drama: “StonkGate.”

StonkGate, if you somehow missed it, refers to the recent clash between Reddit-organized retail investors armed with fintech trading platforms and hedge funds. At the center of the turmoil is Robinhood, a Silicon Valley start-up that vowed to democratize investing. Redditors used the platform to wager billions on meme stocks such as GameStop (GME), AMC (AMC), Nokia (NOK) and others, throwing the market into a volatile pendulum swing. Ultimately, some institutional investors who were shorting the GameStop stock had to be bailed out to the tune of several billion dollars.

To put it in context, although StonkGate has gotten a lot of attention everywhere from Twitter to the White House, the volatility in the market from these few stocks shouldn’t have much of an effect long-term. Aside from those involved directly—Robinhood, its backers and the retail investors who were part of the frenzy—the rest of the market will likely be unfazed and forget the incident in short order. Still, the lasting effect on fintech is yet to be seen. It will likely involve tightening the reins on regulations—particularly when it comes to trading.

What happened?

In short, (no pun intended) Derek Thompson, staff writer at The Atlantic, boiled it down to this:

“The GameStop saga is a ludicrous stock mania born of pandemic boredom and FOMO, piggybacking off of a clever Reddit revenge plot, which targeted hedge funds, who made a reckless bet on a struggling retailer—and it's going to end with lots of people losing incredible amounts of money.”

After suffering outages in prime trading hours for several days, Robinhood restricted its customers' trading to hold or sell on Jan. 28. Lawmakers and others denounced the limits imposed on Robinhood, accusing the start-up of acting unfairly toward ordinary investors. The company was slow to fully explain why it had restricted users from trading the stocks.

Robinhood's co-CEO, Vlad Tenev, appeared on several news outlets in the days that followed, claiming the company did not have a liquidity issue with insulating against potential losses. Rather, he said, it only had to comply with industry requirements and "will always protect our customers." Days later, Tenev disclosed that Robinhood had put the restrictions in place because it did not have enough cash reserves to cover the risky trades. To increase that cash cushion and avoid additional trade restrictions, Robinhood raised $3.4 billion from existing backers—an emergency $1 billion last week and an additional $2.4 billion this week.

In a more transparent but similar move, Anthony Denier, CEO of investing platform Webull, said the platform's clearing firm, Apex Clearing Corp., made the call to shut off the ability to open new positions in certain stocks in late January at the height of the peak. According to Denier, the move was due to spikes in transaction costs, due to risk, during times of volatility. In a Yahoo! Finance interview, Denier explained, "We cannot use customer funds to front that cost due to regulation… so the brokerages or the clearing firms have to go into their own pockets to do it. And they simply can't afford the cost." Denier's explanation was so straightforward that it went viral to explain Robinhood's trading restrictions as well.

Although Robinhood and many other trading platforms face lawsuits, scrutiny and criticism from users and regulators, downloads of Robinhood and other brokerage apps spiked in the last two weeks amongst the meme stock craze.

While #DeleteRobinhoodapp is trending on Twitter, data from SensorTower shows 2.1 million people downloaded the app during the week of Jan. 25, a roughly 400 percent increase from the previous week. Robinhood wasn't the only trading app that saw a significant increase in demand: Webull, TD Ameritrade and Fidelity were all up more than 500 percent week over week.

Here comes the change

Congress now plans to scrutinize fintech's role in the stock market chaos more closely.

Lawmakers aim to investigate whether the fintech apps' democratization of finance could expose users to riskier financial moves and adverse effects. The scrutiny could have significant implications for Silicon Valley and the future of trading apps. The recent rise of GameStop stock and those of other struggling companies have raised questions about whether Washington has paid enough attention to how the democratization of access to financial instruments is transforming U.S. investing. As the pandemic keeps people at home and the recent controversy drives more retail investors to trading apps, the stakes have increased.

The House Financial Services Committee announced that it will host a Feb. 18 hearing on the topic: "Game Stopped? Who Wins and Loses When Short Sellers, Social Media, and Retail Investors Collide." The committee has not yet publicly announced the list of witnesses, but Politico reports that Robinhood CEO Vlad Tenev will testify.

In a Financial Industry Regulatory Authority (FINRA) Examination and Risk Monitoring Program report issued this week, the securities regulator noted an uptick in new retail investors entering the market in 2020 via app-based and online brokerages—a trend that threatens to expose inexperienced investors to riskier, more sophisticated moves such as options trading.

Although the report did not call out any trading apps specifically, the regulator specifically outlined its intended oversight of app-based trading platforms, such as Robinhood, that employ "interactive" or "game-like" features, free stock incentives and zero fees. FINRA contends these practices are predatory, encouraging young or inexperienced investors to take ill-advised risks. The report went as far as to outline these app-based and online brokerages’ various compliance, communications, disclosure and recordkeeping obligations.

With the massive growth in fintech, particularly in investment platforms, regulators may have to provide guidance on how current regulations and financial obligations apply to new technologies. Existing governing obligations lack enforcement cases. In light of recent events, platforms may need to self-enforce in order to actually democratize finance and stay true to their missions. If the goal of the platform is to actually democratize finance, its mission should include protecting its customers.

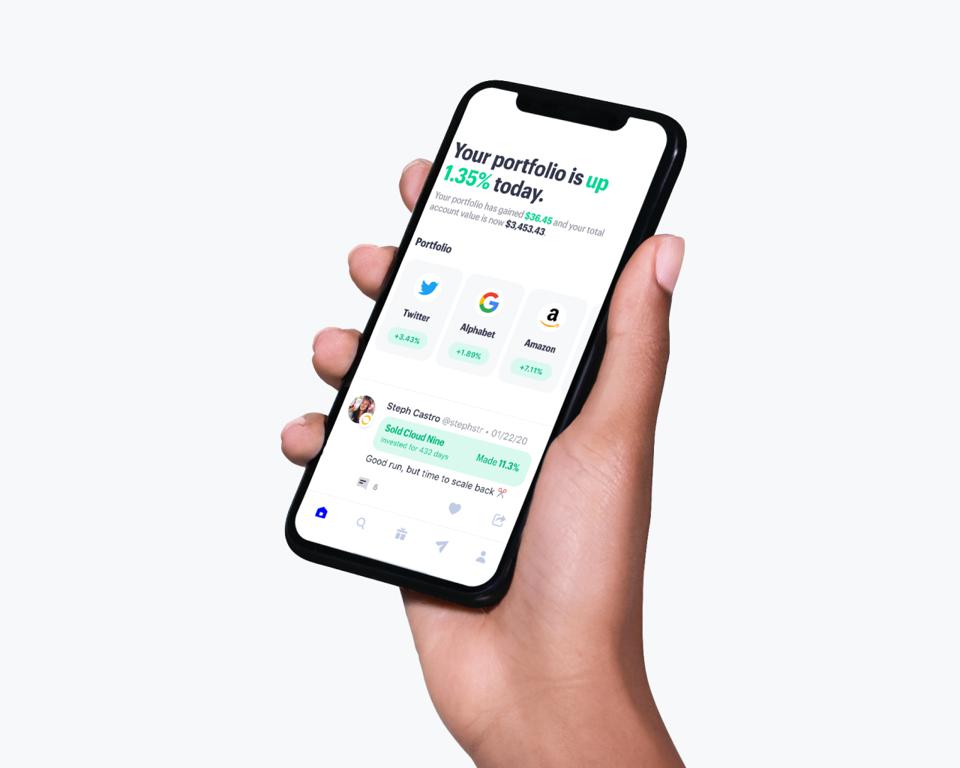

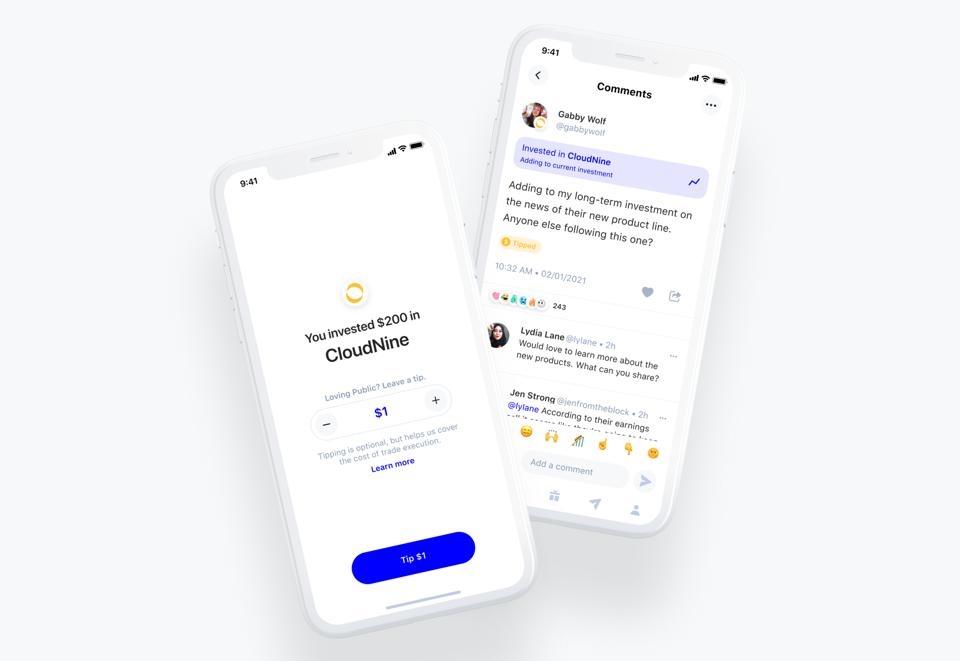

Public, an investing social network, did just that. This week, in a Medium blog post from co-CEO Leif Abraham, the company announced its commitment to no longer participate in Payment for Order Flow (PFOF). PFOF is a common practice where brokerages are paid to route orders to market makers for trade execution, creating a potential conflict of interest between the brokerage and customer. In exchange, Public has plans to introduce an optional tipping feature, a move that the company believes will better align its incentives with those of its members. Abraham explained further:

"In doing so, we're turning what used to be a revenue stream (PFOF) into a cost center, and we're optimistic that the difference will be offset by the optional tipping feature, which we believe is a more transparent and more aligned way to make money."

PUBLIC

The fintech industry can positively shape the financial system, providing opportunity and access to people and places where none previously existed. As with any technology, fintech is neither inherently good nor bad. Instead, its potential impact on society is closely tied to the people and policy decisions guiding its use. Perhaps Robinhood's rally cry to "let the people trade," and Public's declaration that "there is no such thing as free trades,” are both valid.