Welcome to this edition of our Weekly Analyst Insights roundup, which features the key insights our analysts have developed based on the past week’s events.

Our analyst Melody Brue joined the firm in 2020 to cover fintech, but her versatility means that she is now responsible for other areas of enterprise software, plus our “Modern Work” practice—the tools, policies, and strategies that affect things like working from home (or being required to RTO). Last week she wrote a detailed analysis of the new AI-driven Innovation Workspace product from Miro. Fittingly, to round out her coverage of this collaboration app, she worked with our enterprise software development analyst, Jason Andersen, who put Innovation Workspace through its technical paces. We’re always on the lookout for opportunities like this to draw on the different flavors of expertise of Moor Insights & Strategy analysts.

Last week, Patrick and Will were in gorgeous Maui at Qualcomm’s Snapdragon Summit, Melody was back in Florida for Cisco’s WebexOne, and Matt attended the RISC-V Summit virtually.

This week, Patrick will be at AWS HQ in Seattle for an exclusive re:Invent preview, then off to Los Angeles for the analyst session for Cisco’s Partner Summit. Mel will be tuning into SAP SuccessConnect Virtual. Jason (virtually) and Matt will be attending the Red Hat Analyst Day in Boston. Will is off to Riga to spend Halloween at 5G Techritory.

After several weeks of back-to-back travel, our team is looking forward to a brief respite at our desks and home offices as we head into the holidays. We’d love to connect with you over the next several weeks to touch base and discuss your plans for 2025 and beyond. Reach out to schedule some time!

Our MI&S team published 21 deliverables:

Over the last week, MI&S analysts have been quoted in multiple top-tier international publications with our thoughts on IBM, Qualcomm & Arm, Google, Nvidia, the CHIPS Act, and more. Patrick was a guest on Prof G Markets to break down the state of play in the chip industry. He also made appearances on CNBC Power Lunch and Yahoo! Finance.

MI&S Quick Insights

Last week IBM hosted its TechXchange event in Las Vegas. While there has been a lot of attention on the new Granite models (which was the big announcement), the show itself was pretty interesting. Now in its second year, TechXchange focuses on IBM technology practitioners. So by intention, it’s not going to have major product announcements. It also had two other notable differences. First was an incredibly broad span of technologies. There were sessions on the latest AI innovations and DevOps tools, but also quite a bit on IBM mainframes and older technologies such as DB2. Second, IBM very intentionally managed multiple programs to better engage this important part of the IBM community. For instance, IBM has a program to name IBM Champions, who are peer-nominated customer ambassadors. The Champions were easy to find because they had special blue sweatshirts, and there was programming just for them. As an ex-IBM salesperson, I always found that the internal technical sponsor was a big key to growing IBM footprint at a given client. So, I think IBM increasing its focus on that community is a really smart move.

While at TechXchange, I also met Dave Nielsen from IBM, who is a leader of the AI Alliance that IBM co-chairs with Meta. As two of the biggest open source players in AI, I was quite interested to hear how IBM and Meta were collaborating on how to make AI more transparent and safe. I’m looking forward to a follow-up conversation on this soon.

I also had an opportunity to check out UiPath’s Forward and TechEd shows, which ran concurrently last week. UiPath has been a leader in business process automation and robotic process automation for some time now. CEO Daniel Dines is not unique in pitching generative AI as a potential to expand the UiPath universe. While this is not unique, what is unique is how many pieces its existing platform has that could truly accelerate agentic programming. In fact, I was introduced to UiPath after publishing my article on AI Agents last month in Forbes. UiPath is certainly a candidate for the first-mover status I mention in the piece. Also, I was quite taken with the leadership at UiPath. After meeting SVP and general manager Mark Geene and CTO Ragu Malpani, I saw a team that was open, collaborative, and in many ways humble in its approach. This is not something I get to see every day.

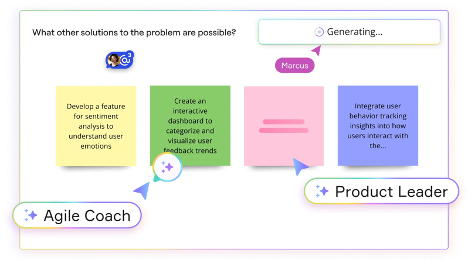

As mentioned in the headnote for this week’s updates, last week my colleague Melody Brue (with some help from me) published this great piece on Miro Innovation Workspace on Forbes. I got to try out the product, using an application development process as a test run of its functionality. Quite frankly, I was impressed with how much the GenAI helped me create a better set of deliverables and how Miro could help overall. While methods like agile and extreme programming push a code-first agenda, I find that in many cases there is still value in taking some time for product owners within the organization to develop a cohesive set of documents to help drive purpose and customer sentiment to the development teams. Now, I am not talking about hundreds of pages of requirements like we see in older methods, but something in between—maybe even just a sprint timeframe for POs and architects to collaborate and get the team on board. What’s nice is that Miro can improve and accelerate that Sprint 0 activity and then feed the data into familiar project management tools like Jira or Monday. It’s worth a look if you are encountering teams that are overly focused on tickets and not the journey itself.

Last week IBM hosted its TechXchange event in Las Vegas. While there has been a lot of attention on the new Granite models (which was the big announcement), the show itself was pretty interesting. Now in its second year, TechXchange focuses on IBM technology practitioners. So by intention, it’s not going to have major product announcements. It also had two other notable differences. First was an incredibly broad span of technologies. There were sessions on the latest AI innovations and DevOps tools, but also quite a bit on IBM mainframes and older technologies such as DB2. Second, IBM very intentionally managed multiple programs to better engage this important part of the IBM community. For instance, IBM has a program to name IBM Champions, who are peer-nominated customer ambassadors. The Champions were easy to find because they had special blue sweatshirts, and there was programming just for them. As an ex-IBM salesperson, I always found that the internal technical sponsor was a big key to growing IBM footprint at a given client. So, I think IBM increasing its focus on that community is a really smart move.

While at TechXchange, I also met Dave Nielsen from IBM, who is a leader of the AI Alliance that IBM co-chairs with Meta. As two of the biggest open source players in AI, I was quite interested to hear how IBM and Meta were collaborating on how to make AI more transparent and safe. I’m looking forward to a follow-up conversation on this soon.

I also had an opportunity to check out UiPath’s Forward and TechEd shows, which ran concurrently last week. UiPath has been a leader in business process automation and robotic process automation for some time now. CEO Daniel Dines is not unique in pitching generative AI as a potential to expand the UiPath universe. While this is not unique, what is unique is how many pieces its existing platform has that could truly accelerate agentic programming. In fact, I was introduced to UiPath after publishing my article on AI Agents last month in Forbes. UiPath is certainly a candidate for the first-mover status I mention in the piece. Also, I was quite taken with the leadership at UiPath. After meeting SVP and general manager Mark Geene and CTO Ragu Malpani, I saw a team that was open, collaborative, and in many ways humble in its approach. This is not something I get to see every day.

As mentioned in the headnote for this week’s updates, last week my colleague Melody Brue (with some help from me) published this great piece on Miro Innovation Workspace on Forbes. I got to try out the product, using an application development process as a test run of its functionality. Quite frankly, I was impressed with how much the GenAI helped me create a better set of deliverables and how Miro could help overall. While methods like agile and extreme programming push a code-first agenda, I find that in many cases there is still value in taking some time for product owners within the organization to develop a cohesive set of documents to help drive purpose and customer sentiment to the development teams. Now, I am not talking about hundreds of pages of requirements like we see in older methods, but something in between—maybe even just a sprint timeframe for POs and architects to collaborate and get the team on board. What’s nice is that Miro can improve and accelerate that Sprint 0 activity and then feed the data into familiar project management tools like Jira or Monday. It’s worth a look if you are encountering teams that are overly focused on tickets and not the journey itself.

IBM unveiled the third generation of Granite LLMs—the Granite 3.0 models—featuring Granite 3.0 2B Instruct and Granite 3.0 8B Instruct. These open-source models were trained on 12 trillion tokens in 12 human languages and 116 programming languages. The 3.0 models can be used for RAG summarization, entity extraction, and editing. According to IBM, by the end of 2024 Granite 3.0 models will be capable of understanding documents, interpreting charts, and answering questions about a GUI or product screen.

Agentic use cases are new capabilities. Agents can proactively identify needs, utilize tools, and initiate actions without human intervention. This advancement marks a significant step forward in the functionality and autonomy of IBM’s language models.

Anthropic announced some important model upgrades—Claude 3.5 Sonnet and Claude 3.5 Haiku, plus a new “computer use” feature. Anthropic has improved Claude 3.5 Sonnet’s coding and tool use. Claude 3.5 Haiku has better performance, but at the same cost and speed as the previous version. With “computer use,” AI can control computer interface actions such as cursor control and typing information with human-like precision. These improvements show even more ways that AI has the potential to automate complex tasks and improve productivity.

I shared a car service last week with a gentleman from a competing analyst firm. This man, who is based in Latin America, was talking about how he would be on the road for four straight weeks covering Huawei (yes, that Huawei) events. This got me thinking a little bit. I remember that when I first started at MI&S, Huawei was a company that most analyst firms covered—and for good reason. It had solutions that fit in every technology category: silicon, hardware, software, cloud; client, server, networking, storage, and phone; consumer and commercial; and even consulting services. I was invited to the company’s analyst meeting and walked away fully in awe of the breadth and depth of its portfolio.

Fast forward seven years or so years and Huawei is everywhere—except the U.S. and Canada. If you chat with U.S. government officials or major U.S. OEMs, you’ll hear that this all has to do with the company being under the control of the Chinese government. If you ask U.S. IT executives, you’ll hear much of the same.

Is this concern real? Or is there more to the story? I think it’s the latter. First, there was the controversy about—and banning of—China-based ZTE Systems in the United States after the company was found to be illegally shipping technology to Iran and North Korea. After that, there was a very strong anti-Chinese sentiment in the United States (and some Western European countries) with regards to technology. In that vein, we eventually saw server manufacturer Inspur get placed on the U.S. exemption list and get hit with a patent infringement lawsuit.

Second, I believe U.S.-based server vendors saw a real threat from Huawei and put a lot of money into lobbying against the company in D.C. What better way to protect against the market threat of this company than to amplify a “national security threat” concern with lawmakers and policy folks?

I am not an advocate of Huawei, and I’m not a geopolitical expert. However, when a product or technology is used pretty much everywhere except in one or two countries—I figure something is amiss.

Can’t we all just get along? There is a lot of noise around the Arm and Qualcomm licensing dispute. And there are a lot of opinions. The licensing issue originates with Qualcomm’s acquisition of Nuvia—a company that included many ex-Apple chip designers focused on developing Arm-based chips to compete with x86. Effectively, they wanted to create a commercial version of the M-Series chips that we see in the Apple MacBook. Here’s the rub: Arm says that the Qualcomm acquisition nullified the Nuvia architectural license. So, in effect, those Oryon cores that are inside the Snapdragon CPU should not be shipping to Dell, HP, Lenovo, Microsoft, and others. And oh yeah, there is more Nuvia-derived IP that hasn’t yet come to market but could also be considered in violation of the architectural license.

Qualcomm says “no way” and that Arm is employing anti-competitive practices.

It’s easy for pundits to point fingers and pick a side. But these architectural licenses are very complex—and very specific. Enough so that they are far beyond my (and most folks’) cursory understanding of IP law and the specifics of this agreement.

Here’s what I do know. Regardless of what the outcome of a court case may be, nobody wins here. If Arm follows through with its termination of the agreement—nobody wins. If Qualcomm prevails on its own terms—nobody wins. There has to be a settled agreement between the two parties, one in which both walk away feeling good about the relationship and in which neither feels overly emboldened. This isn’t about only Arm Holdings or only Qualcomm winning. It’s about Arm maintaining a strong market position relative to x86. This licensing issue dragging out and becoming overly burdensome on one side or not profitable enough on the other side is going to have a long-lasting negative impact across the entire Arm market.

McAfee and Yahoo News are teaming up to fight deepfakes in the news with an AI-powered detection tool. This tool, driven by McAfee Smart AI, analyzes images for signs of AI manipulation and flags them for review by Yahoo’s editors. This effort is similar in spirit to Adobe’s Content Authenticity Initiative, which allows creators to attach “nutrition labels” to their digital content, providing details about how it was created and edited. While Adobe’s initiative promotes transparency across various digital media, McAfee focuses on protecting the integrity of news media, a critical area of concern as deepfakes become increasingly sophisticated. This collaboration could prove essential to preserving trust and credibility in the news, especially during critical events where misinformation can have significant consequences.

Both McAfee and Adobe are utilizing AI to combat misinformation and foster trust in digital content, but their approaches differ. McAfee’s new partnership with Yahoo News focuses specifically on detecting deepfakes in news media, while Adobe’s Content Authenticity Initiative aims for broader transparency across various digital content through “nutrition labels” detailing creation and editing history. This difference reflects their specific priorities and target audiences. However, with growing support for content authenticity across the board, I suspect that a collaboration between the two tech companies could be on the horizon, potentially leading to even more robust solutions for verifying digital content.

Jira, long known for helping software developers manage projects, has been branching out to support marketing teams. This is happening at a time when marketing workflows are becoming increasingly complex, with higher-velocity campaigns, more stakeholders, and a wider range of channels to manage. This complexity makes staying organized and on track more challenging than ever. Jira’s tools should help marketers streamline their work, improve communication, and track progress more effectively. This push to be more than a dev tool is evident in its new “Jira for Marketers” series, a live learning session set to show marketing professionals how to use Jira to manage campaigns, content creation, and events. It’s a smart move by Jira, recognizing that many teams, not just software engineers, can apply agile development and project management principles.

Zoho announced a partnership with Nvidia to boost its AI capabilities, specifically in developing and deploying LLMs for its business software. This significant move for Zoho shows its commitment to providing robust, business-focused AI solutions. Zoho plans to use Nvidia’s AI Enterprise software and accelerated computing platform to build LLMs tailored for various business needs, focusing on privacy and providing contextually relevant information. The company aims to help businesses see a fast return on their investment by using AI to speed up operations and reduce delays. This partnership allows Zoho to accelerate its LLM deployment and optimize performance. It’s clear that Zoho is serious about AI and is making strategic moves to become a leader in enterprise AI for its market.

IBM has acquired Prescinto, a company that makes software for renewable energy asset management. The acquisition will enhance IBM’s Maximo Application Suite by enabling it to manage renewable assets such as solar panels and wind turbines. This expansion adds to Maximo’s existing enterprise asset management (EAM) capabilities for managing physical assets such as buildings and infrastructure, inventory, work orders, and maintenance. Prescinto’s AI-driven tools should improve Maximo’s analytics and predictive maintenance features, enabling users to optimize the management of renewable energy assets. By consolidating renewable energy asset management into Maximo, IBM aims to simplify customers’ operations by eliminating the need for separate systems.

Spirent recently published a report highlighting the opportunity for Ethernet to benefit from the growing adoption of next-generation AI applications. It’s not a surprising conclusion, especially given recent efforts by AMD in productizing its silicon for Ultra Ethernet Consortium network interface cards that utilize RoCEv2 to power back-end data center interconnect fabrics. (For more details on that, see my recent research brief that covers the AMD NIC.)

SAP has launched its Sustainability Data Exchange, a SaaS application designed to help enterprises achieve their net-zero goals by enabling standardized carbon data sharing across supply chains. Gunther Rothermel, chief product officer and co-general manager of SAP Sustainability, said, “Managing carbon to accelerate a net-zero future makes measurability critically important. That is where technology and innovation can make a real difference. With SAP Sustainability solutions and our ERP-centric, cloud-based, AI-enabled approach, we support our customers to use integrated sustainability data and embed it holistically into their core business processes.”

One specific advantage of this SAP application is that it assists enterprises in transitioning from estimates to actual emissions data. The platform ensures accurate carbon footprint tracking by integrating with SAP’s ERP ecosystem and supporting industry standards such as Catena-X and PACT. With sustainability being a key focus for many businesses in 2025, this solution demonstrates SAP’s commitment to providing an intelligent sustainability platform for enterprises. You can read more on this in my upcoming article on sustainability practices enabled by ERP.

SAP also reported strong financial Q3 2024 results, demonstrating growth with its cloud-based ERP solutions. Total revenue increased 9% year-over-year to €8.47 billion, with cloud revenue rising 25% to €4.35 billion. The Cloud ERP Suite saw a 34% revenue increase, indicating its continuing appeal for helping businesses manage operations more efficiently in the cloud. The company’s operating profit and free cash flow also grew, improving by 29% and 44%, respectively. SAP has made a big commitment to supporting customers’ digital transformation efforts, an approach enhanced by its acquisition of WalkMe (which has already begun to contribute to the company’s backlog of cloud business). Meanwhile, SAP’s overall results show the success of its strategic efforts to shift customers towards cloud-based ERP systems.

Microsoft has launched autonomous agents for Microsoft Copilot Studio and Microsoft Dynamics 365, the company’s ERP/CRM platform. Microsoft has introduced ten new AI agents for Dynamics 365, focusing on sales, customer service, finance, and supply chain operations. These agents are designed to automate routine tasks, improve workflows, and increase efficiency. Of course, there are challenges, including ensuring data security and privacy, integrating with current systems, and maintaining accuracy.

Agents are a key advancement for Microsoft Dynamics 365 Finance and Supply Chain, bringing flexibility to data management and task execution. The company says that the supply chain agents can help identify bottlenecks and disruptions, suggest improvements, and optimize order fulfillment. AI agents can support payment processing and compliance in finance and provide real-time data for better financial planning. More to come on this topic.

Call of Duty: Black Ops 6 is out, and I’ve already had a chance to play it. What makes this year’s version stand out isn’t that it’s a particularly new or exciting game—it’s the fact that the game is available for the first time via Microsoft’s monthly game subscription service, XBOX Game Pass. This service is how Microsoft plans to continue to grow its gaming business into a recurring revenue source, and in that context Call of Duty was a big part of why Microsoft paid $69 billion for Activision Blizzard, which makes the game.

That said, the game still has to be attractive and exciting enough to get people to keep subscribing, and I believe that Microsoft could ultimately convince gamers of the value of Game Pass—with its many titles—rather than just buying an individual game. I haven’t played the new Call of Duty enough to decide whether it’ll be a success or a flop, but I do know that a lot of people are playing it right now. If they still are in a few weeks, that’ll be a good sign for Microsoft.

AWS announced the end-of-life of AWS IoT Device Management Fleet Hub, a service that sits on top of AWS IoT Device Management and overlaps some features in AWS IoT Console. Conceptually, it’s a dashboard generator that creates applications (“single panes of glass”) through which customers can monitor large numbers of IoT devices. AWS will permanently decommission Fleet Hub a year from now, on October 18, 2025.

I see two reasons for this abrupt EOL. (1) Application generators have evolved considerably since Fleet Hub’s launch four years ago, so it’s time to refresh or rewrite. (2) Extreme device diversity requires extensive (and brittle) interface customization, which often costs more than the benefits of orchestration. The EOL press release says it this way: “As technology and customer needs continue to evolve, we have made a decision to discontinue the feature.” In other words, the solution needs to be rewritten, and doing so doesn’t make sense because the device interface diversity problem remains unsolved.

This is the right decision for AWS. Device diversity should be managed and simplified in IoT middleware, not the user-facing application layer. Smarter middleware with simple APIs that enable high-level device management makes fleet management practical. My take: Efficient IoT device orchestration requires a consistent model for middleware. A few visionary companies are already working on that, and I’ll offer a deeper analysis in an upcoming paper.

This week, Honeywell and Google Cloud announced a collaboration project focused on developing AI-based solutions to two big problems common to many industries: (1) A looming talent shortage and skills gap in the industrial sector, and (2) on-device AI for autonomous operation. Honeywell and Google aim to address the talent gap by making industrial processes increasingly autonomous, leveraging Google’s Vertex AI to customize, train, and deploy ML models and AI applications.

Suresh Venkatarayalu, Honeywell’s CTO and president of Honeywell Connected Enterprise, says, “We’re moving from automation to autonomy. Our goal is to equip companies with AI agents that assist workers in real time—on factory floors and in the field. With AI running both in the cloud and at the edge, we’re making sure that systems work smarter and more efficiently.” In addition to using autonomy to reduce dependencies on scarce talent and skills, the companies are extending Honeywell Forge, a massive database of industrial knowledge, with Vertex AI and LLMs. The idea is to create AI “coaching” agents that deliver helpful information when and where employees need it.

Industrial processes require continuous operation, even when the Internet is down or cloud services are unavailable. Google’s Gemini Nano addresses this problem by providing AI services at the edge of the network, enabling devices like scanners, cameras, sensors, and controllers to operate autonomously. Honeywell’s first solutions built with Google Cloud AI will hit the market in 2025.

My take: Last year, Siemens and Microsoft made a similar deal. Big industrial suppliers are pairing up with CSPs to accelerate the development of advanced AI-based solutions. This is how AI gets a blue-collar job and starts working for a living.

At the same time Qualcomm launched its newest mobile and automotive platforms in Hawaii last week, Bloomberg reported that Arm decided to terminate Qualcomm’s v8 architectural license to escalate the two companies’ ongoing IP dispute. I consider this to be the nuclear option, and it seems like a very odd move considering that the two are expected to be in court in less than 60 days. I believe that this is a mistake on Arm’s part, especially since Qualcomm is one of its biggest partners, and won’t bode well for how other vendors see Arm. Additionally, the entire RISC-V ecosystem is salivating at the prospect of having a company like Qualcomm backing their efforts, especially considering China’s appetite for RISC-V. I believe that Arm and Qualcomm are mostly fighting over egos rather than a few million dollars here or there for either company. This will hurt the ecosystem that Arm claims to be protecting.

AT&T and Verizon both say they are seeing reduced excitement around the iPhone 16 series, even with generous trade-in offers. People just aren’t sold on Apple Intelligence as a reason to upgrade, especially since Apple’s AI product hasn’t properly launched yet and won’t be fully available until next year. While Apple will absolutely continue to market these features, the reality is that consumers won’t be convinced that they are real until they are all available and functioning outside of beta. That might not be until Q2 of next year, which is why analyst Ming-Chi Kuo has said that Apple has reduced its orders of iPhone 16 by 10 million over the next few quarters.

AST SpaceMobile continues to be on a roll with the news that it has won a contract with the U.S. Government that qualifies it as a Prime Contractor for the US DoD, which enables it to win more federal contracts. Additionally, the company has successfully unfolded its first five commercial satellites, which it had recently launched into LEO with SpaceX. AST SpaceMobile may soon be a viable alternative to Starlink from SpaceX, which also recently announced that it would be delivering commercial direct-to-cell service with T-Mobile by the end of the year.

Cisco launched its new Ceiling Microphone Pro at WebexOne last week which was designed to enhance audio quality and flexibility in meeting rooms. The microphone uses beamforming technology to capture sound from a specific area, minimizing background noise to ensure clear audio for both in-room and remote participants. It offers unidirectional and omnidirectional modes, adapting to different room sizes and configurations. It’s designed for plug-and-play installation and integrates with Cisco’s Room and Board Series endpoints. IT can also manage it remotely through an administrator portal.

I saw this microphone firsthand at Cisco’s WebexOne conference in the Miami area. The ceiling-mounted design minimizes clutter and provides a clean aesthetic that looks very modern but not cold. Notably, this microphone is the first product to showcase Cisco’s new design language, which prioritizes sustainability with a soft, organic shape contrasted with sharp, defining lines. It’s constructed entirely of aluminum, a highly recycled and recyclable material, and even the speaker grille is a structural element, not just a cosmetic cover. Cisco also considered the manufacturing process in its design, placing a seam between components on the top surface to make assembly more forgiving. Furthermore, it’s the first Cisco product to ship with zero plastic packaging, reflecting Cisco’s increasing commitment to environmentally conscious product development.

Cisco also launched Workspace Designer, an online tool that uses Cisco’s collaboration technology to simplify the process of planning and equipping meeting rooms. Users can choose from various room sizes and layouts, experiment with different device configurations and furniture placements, and even receive recommendations on the best technology for their needs. The tool aims to reduce the complexity often associated with designing adequate meeting spaces, which previously might have required extensive consultations and a lot of guesswork. Workspace Designer also provides helpful warnings and tips, such as flagging potential speaker or camera placement issues that could impact audio or video quality. This allows users to proactively address potential problems and optimize their meeting rooms for effective communication and collaboration. Cisco’s goal with all of its collaboration devices and technology is to reach what Cisco refers to as “Distance Zero”—where everyone feels no distance from meeting participants, regardless of their location.

Zoom has launched AI Companion 2.0, a significant upgrade to its AI assistant, with expanded capabilities for summarizing meetings and chat threads, generating content like emails and meeting agendas, and automating tasks. AI Companion 2.0 works across various Zoom products, including Team Chat, Whiteboard, Mail, and Meetings. While Zoom’s AI strategy is generally strong, it’s often underestimated. Many users may not fully grasp the sophistication of Zoom’s AI capabilities, even though they use features such as AI summaries and noise cancellation regularly—and those features are outstanding.

In my opinion, Zoom needs to better articulate the value of its AI features, even those offered for no additional charge. By clearly demonstrating the advantages of its AI-powered tools, Zoom can increase user appreciation for these capabilities and potentially drive the adoption of more advanced, paid AI features. This clearer communication is essential for Zoom to fully capitalize on its AI investments and remain competitive.

Apple has announced that this week will be full of Mac news, which I believe will be Apple’s way of releasing the M4 chip and all its variants across desktop, laptop, and mini form factors. This will also give Apple an opportunity to (try to) reassert the M4’s performance leadership over Intel, AMD, and Qualcomm—which I believe that it could do, considering the M4 iPad’s thermal and power limitations. It will likely be an interesting week of cherry-picked benchmarks with questionable scaling and no labels on any graphs. Nevertheless, we’ll get plenty of talk about AI and Apple Intelligence, I’m sure.

IBM has opened its first quantum datacenter in Europe, located in Ehningen, Germany. The datacenter has two quantum computers to support the growing demand from European businesses, research institutions, and government agencies.

The establishment of this datacenter is part of IBM’s broader strategy to advance quantum computing technology and foster a robust quantum ecosystem in Europe. The datacenter will also facilitate compliance with European data sovereignty requirements, ensuring that sensitive data remains within the region. See my full writeup on Forbes for more details.

At its Oktane 2024 conference, Okta announced new capabilities tied to securing generative AI applications. GenAI is poised to reimagine consumer and enterprise applications, but it creates security risks given the use of personal and shared data, underlying algorithms, and large language models, API calls, and more. To address these challenges, Okta announced a new product within its Customer Identity Cloud portfolio: Auth for GenAI.

Auth for GenAI enables developers to build next-generation AI agents and applications securely while not introducing unnecessary constraints that could stifle innovation or create a cumbersome customer experience. Okta’s ability to facilitate security by design for GenAI developers is potentially powerful, anchored by its leadership in identity and access management. See my Analyst Insight piece for more details.

Last week Qualcomm announced products in the mobile and automotive categories at its annual Snapdragon Summit. All the announced products leveraged Qualcomm’s new second-generation Oryon CPU-based SoCs. These new chips significantly improve upon the first generation and deliver mind-melting performance improvements north of 40% on CPU and GPU while also bringing real competition to Apple. Qualcomm is also the first Arm vendor for Android to hit 4 GHz on an ARM architecture. The new Snapdragon 8 Elite mobile processor features the new Oryon CPU cores, as do the new Snapdragon Ride Elite and Cockpit Elite. These products set an entirely new standard for mobile and automotive compute that will heat things up against Apple—and likely find their way into the next generation of Snapdragon X Elite platforms for Windows PCs.

The world of sports technology is constantly evolving, and we knew early on that our Game Time Tech podcast and sports technology advisory practice had to stay ahead of the curve. These days, it’s not just the tech conferences buzzing about sports technology—I’m also starting to see dedicated sports tech tracks emerge at finance conferences. This signals a shift in how these innovations are perceived, especially as operations teams demonstrate how technology can drive operational efficiencies and contribute directly to the bottom line. With CFOs increasingly recognizing the financial benefits, things are about to get even more interesting. The days of marketing teams lobbying for sports sponsorship dollars or IT teams justifying tech spend might be over. I’m excited to see how finance and accounting teams drive this next wave of sports innovation as the ROI of these technologies becomes increasingly apparent. Stay tuned for a finance-focused GTT pod coming soon!

Meta’s new Meta Quest back-of-shirt partnership with Wrexham AFC—both the men’s and women’s teams—should bring some exciting opportunities for fans. Through virtual reality, supporters can enjoy virtual stadium tours, behind-the-scenes views, and interactive gameplay. This collaboration opens new avenues for fans to engage and connect online and potentially in person using Meta’s cutting-edge VR technology.

“We’re so excited to welcome Meta Quest as our back-of-shirt sponsor,” said Wrexham AFC co-chairmen Rob McElhenney and Ryan Reynolds. “Meta Quest allows you to immerse yourself in new worlds and experiences and is all about connection—something that resonates with us at Wrexham AFC.”

Meta’s involvement further enhances Wrexham’s visibility, aligning with the club’s growing fanbase following the popular Welcome to Wrexham series on FX. Wrexham supporters may also get to benefit from special offers, such as discounts on Meta Quest headsets.

AT&T and T-Mobile published their respective 3Q 2024 earnings this week. AT&T continues to build momentum for its fiber franchise with an impressive 19 consecutive quarters of 200,000 net adds. Broadband continues to be a bright spot for the company, balancing flat mobility top-line revenue. I also expect that AT&T’s relationship with AST SpaceMobile will facilitate monetization of new rural mobility applications in agriculture technology as that commercial low earth orbit (LEO) satellite constellation matures.

T-Mobile continues its impressive financial performance, buoyed by significant net income growth. A key contributor is its 5G fixed wireless access business. I also believe the company will enjoy continued revenue upside in broadband services as it readies an aggressive push with fiber.

Forbes Articles Published

- IBM’s New Granite 3.0 AI Models Show Strong Performance On Benchmarks (Paul Smith-Goodson)

- Samsung Galaxy Book4 Edge 16 Review: Biggest Snapdragon X Elite Laptop (Anshel Sag)

- Snap Spectacles AR Glasses: The Embodiment of AR Making AI Fun (Anshel Sag)

- Miro Redefines Collaboration Tools with AI-Driven Innovation Workspace (Melody Brue, Jason Andersen)

- Apple iPhone 16 Fall Event: New Wearables Shine, But AI Lags (Anshel Sag)

- IBM Opens Its First Quantum Data Center In Europe (Paul Smith-Goodson)

Blog Posts Published

- Oktane 2024 Fuels GenAI and Cloud-Native Application Security (Will Townsend)

- MI&S Weekly Analyst Insights — Week Ending October 18, 2024 (Analyst Team)

Podcasts Published

Game Time Tech (Melody Brue, Robert Kramer, Jason Andersen)

Six Five (Patrick Moorhead)

- Ep. 238: We are Live! Talking Qualcomm, Arm & Qualcomm, SAP, IBM, ServiceNow, NVIDIA

- Six Five On the Road — Transforming Enterprise Computing: CTO Insights on AI PCs

- Six Five On the Road: Propelling the Next Wave of AI Productivity

- Six Five On the Road at AdobeMAX: Adobe Introduces GenStudio for Performance Marketing

Don’t miss future MI&S Podcast episodes! Subscribe to our YouTube Channel here.

Citations

IBM / Granite 3.0 / Patrick Moorhead / Fierce Network

IBM’s new generation of models carves a path for open-source AI

IBM / Granite 3.0 / Patrick Moorhead / Info World

IBM works to address the developer skills gap with AI

IBM / Granite 3.0 / Patrick Moorhead / TechTarget

IBM launches new generation Granite language model

Intel / EU Fine / Anshel Sag / Computer World

Billion-dollar fine against Intel annulled, says EU Court of Justice

CHIPS Act / Patrick Moorhead / Investor’s Business Daily

Uncle Sam Wants Semiconductors Made In America. The CHIPS Act May Fall Short

Qualcomm / Snapdragon 8 Elite / Patrick Moorhead / Fierce Electronics

How Qualcomm mobile AI busts out as Snapdragon 8 Elite

Qualcomm & Arm / Licensing Feud / Patrick Moorhead / Fierce Electronics

Arm threatens to end Qualcomm license as ongoing spat heats up

Qualcomm & Arm / Licensing Feud / Anshel Sag / Serve The Home

Arm Moves to Cancel its Design License with Qualcomm

_____

TV APPEARANCES

CNBC Power Lunch / Google / Patrick Moorhead

Google has nice growth this year and expect the same next year, says FBB Capital’s Mike Bailey

Prof G Markets / Podcast Guest / Patrick Moorhead

Nvidia’s Rise, Intel’s Fall, and the Chips in Between — ft. Patrick Moorhead | Prof G Markets

Yahoo! Finance / Arm and Qualcomm Licensing Feud & NVIDIA Blackwell / Patrick Moorhead

Nvidia’s Blackwell woes revealed ‘drama’ between chip partners and

How did Arm and Qualcomm’s ‘symbiotic’ partnership go south?

New Gear or Software We Are Using and Testing

- Kindle Colorsoft (Anshel Sag)

- Google Pixel Buds 2 Pro (Anshel Sag)

- Google Pixel Watch 3, 41mm (Anshel Sag)

- Cisco Desk Pro (Melody Brue)

- OnePlus Buds Pro 3 (Anshel Sag)

- Insta360 Link2 4K AI Webcam (Anshel Sag)

- Google Pixel 9 Pro Fold (Anshel Sag)

- Google TV streamer – Matter and Thread features (Bill Curtis)

- Various Matter devices (Bill Curtis)

- ASUS Zephyrus G16 Gaming Laptop (Anshel Sag)

- iPhone 16 Pro (Anshel Sag)

Events MI&S Plans on Attending In-Person or Virtually (New)

Unless otherwise noted, our analysts will be attending the following events in person.

- Cisco Partner Summit, Los Angeles, October 28–30, 2024 (Robert Kramer)

- SAP SuccessConnect, October 28-30 – virtual (Melody Brue)

- Red Hat Analyst Day, October 29 (Matt Kimball, Jason Andersen — virtual)

- GitHub Universe, October 29-30, San Francisco (Jason Andersen)

- 5G Techritory, October 30-31, Riga (Will Townsend)

- Cisco Partner Summit, Los Angeles, October 28–30, 2024 (Robert Kramer)

- SAP SuccessConnect, October 28-30 – virtual (Melody Brue)

- Red Hat Analyst Day, October 29 (Matt Kimball, Jason Andersen — virtual)

- GitHub Universe, October 29-30, San Francisco (Jason Andersen)

- 5G Techritory, October 30-31, Riga (Will Townsend)

- Dell Tech Analyst Summit, November 6-8, Austin (Matt Kimball, Anshel Sag, Paul Smith-Goodson)

- Apptio TBM Conference, November 4-5, San Diego (Jason Andersen)

- IBM, November 6-8, New York City (Paul Smith-Goodson)

- Veeam Analyst Summit, November 11-13, Scottsdale, AZ (Robert Kramer)

- Box Analyst Summit, November 12-13, San Francisco (Melody Brue)

- Microsoft Ignite, November 18-22, Chicago (Robert Kramer – virtual, Will Townsend – virtual)

- Super Computing, November 18-22, Atlanta (Matt Kimball)

- NTT R&D Forum, November 19-23, Tokyo (Will Townsend)

- AWS re:Invent, December 2-6, Las Vegas (Robert Kramer, Will Townsend, Jason Andersen, Paul Smith-Goodson, Matt Kimball)

- IBM Strategic Analyst Event, December 9, Boston (Robert Kramer)

- T-Mobile Analyst Summit, December 9-10 (Anshel Sag)

- Marvel Industry Analyst Day, December 10, Santa Clara (Matt Kimball)

- ServiceNow Global Industry Analyst Digital Summit, December 10 (Jason Andersen, Melody Brue, Robert Kramer – virtual)

- Acumatica Summit, January 26-29, Las Vegas (Robert Kramer)

- ZohoDay25, February 3-5, Austin (Robert Kramer, Melody Brue)

- Zendesk Analyst Day, March 35, Las Vegas (Melody Brue)

Subscribe

Want to talk to the team? Get in touch here!