The industry needed a useful, functional model of the Internet of Things (IoT) to frame recent developments in the space. But Moor Insights & Strategy could not find one that was sufficiently vendor-neutral, technology-neutral, and jargon-neutral, and at the same time, both simple to understand and comprehensive. So we created our own. Unlike previous attempts, we created an IoT segmentation that is almost entirely defined by behaviors rather than by technology.

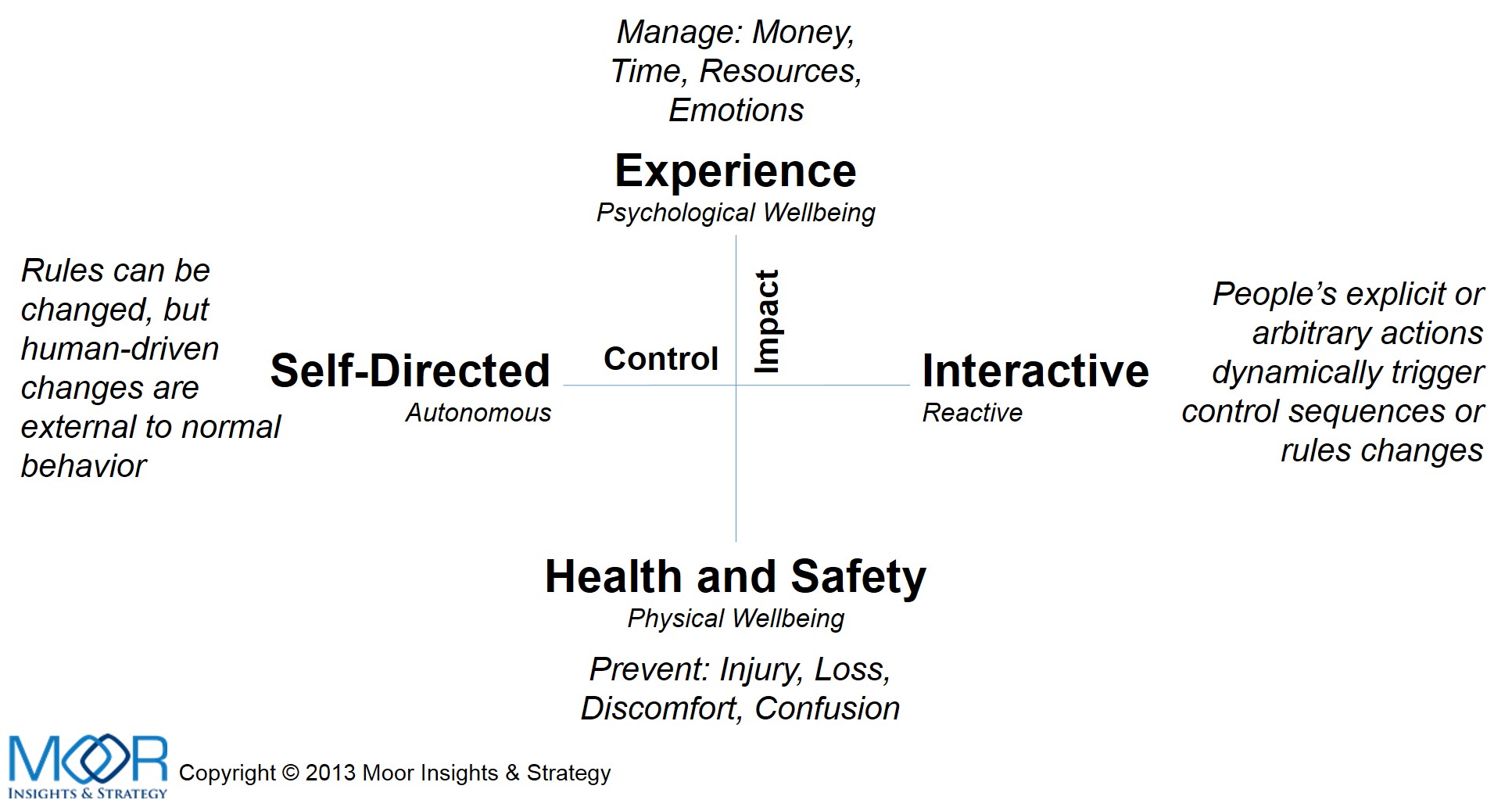

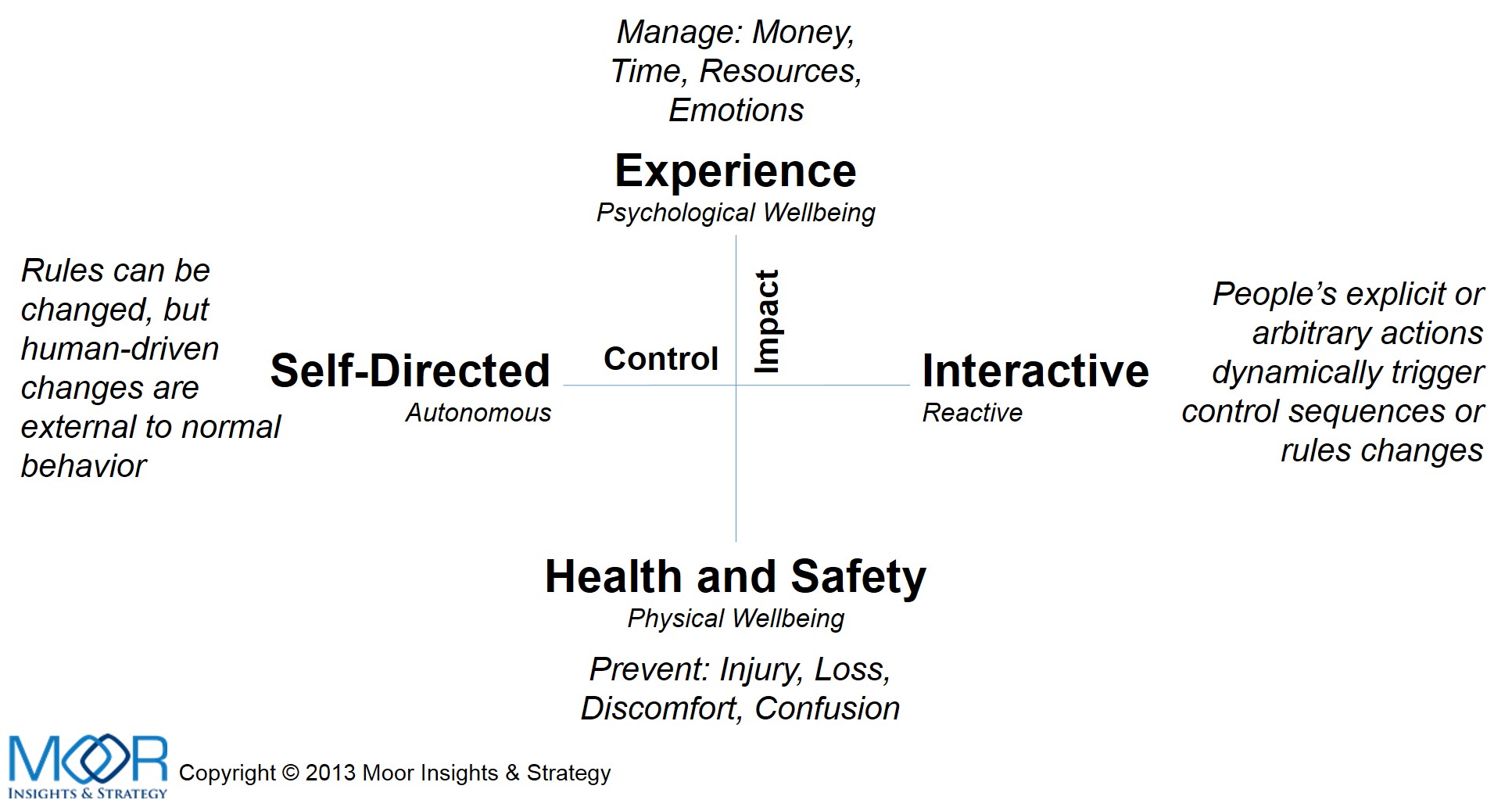

The two main axes in our IoT map are Impact (vertical) and Control (horizontal).

“Impact” describes the impact of technology on human well-being. It loosely follows Maslow’s Hierarchy of Needs. The opposite ends of Impact are

“Health and Safety,” systems that enable a baseline for a safe, comfortable life, and “Experience,” systems that address emotional and aspirational needs related to personal status and achievements.

“Control” describes a range of control interactions that people exert on technology, from self-directed to interactive systems. The opposite ends of Control are

“Self-Directed,” systems purpose designed to set in motion and operate with as little human interaction as possible, and “Interactive” systems designed for constant and personal human interactivity and responsiveness.

This division between systems that operate continuously by a set of rules and systems that interact dynamically with humans creates a useful distinction between autonomous

“Industrial” systems and reactive

“Human” systems. We map that onto our horizontal Control axis. Our top-level split for the IoT space is a bifurcation into the Industrial Internet of Things (IIoT) and the Human Internet of Things (HIoT).

“Switching costs” is an economic term used to describe the barriers a customer must overcome before they choose to shift their purchase of a product or service to a different supplier. We’ve noticed an inverse relationship between switching costs for sensors and switching costs for services at different points on the Impact spectrum (vertical axis).

The key attribute separating the top two segments from the bottom two is that for the top half of the chart, end-points are almost always replaced when a service provider is switched for a functional equivalent. End-points in the bottom half are too expensive or too difficult to replace, and so service ecosystems will become the fungible component, if they are not already.

The four segments we derive from the Control and Impact axes are described in more detail in the paper you can download

here. Our four segments are easy to understand and describe a wide range of IoT systems and their value. We will continue the threads we’ve started in our paper in future papers and blogs.

- Charting Our Course

- Segmenting Industrial and Human Internet of Things

- Coloring the IIoT “Brown” and HIoT Opportunity “Green”

- Identifying Switching Costs

- Segmenting the IoT Market

- Closing Words

- Table 1: Near-term end-point differences between IIoT and HIoT

- Figure 1: IoT Landscape

- Figure 2: IoT Divided into Industrial vs. Human IoTs

- Figure 3: IoT Divided by Services Switching Cost

- Figure 4: IoT Segments

You can download the paper

here.

Patrick founded the firm based on his real-world world technology experiences with the understanding of what he wasn’t getting from analysts and consultants. Ten years later, Patrick is ranked #1 among technology industry analysts in terms of “power” (ARInsights) in “press citations” (Apollo Research). Moorhead is a contributor at Forbes and frequently appears on CNBC. He is a broad-based analyst covering a wide variety of topics including the cloud, enterprise SaaS, collaboration, client computing, and semiconductors. He has 30 years of experience including 15 years of executive experience at high tech companies (NCR, AT&T, Compaq, now HP, and AMD) leading strategy, product management, product marketing, and corporate marketing, including three industry board appointments.