The hyperconverged infrastructure (HCI) market has always been more competitive than market share numbers would indicate. While VMware has been the leader in this segment, Nutanix has always been a formidable number two that has continuously pushed the envelope across all vectors—technology, partnerships, go-to-market, and channel enablement. Despite VMware’s incredibly advantageous relationship with Dell, Nutanix has continually grown its market share and competitive positioning.

Given the company’s continued aggressive approach and market conditions, 2024 looks like a good year for Nutanix. I expect the company to continue to gain market share and deepen its technical partnerships. I’ll explain why (and how) in the following sections.

It’s all about the cloud

Since Nutanix first introduced the concept of HCI back in 2011, the company has been very good at simplifying IT. Some would argue that it is almost too good, in fact. I remember talking to a friend and ex-IT colleague several years ago who used Nutanix at several companies. He spoke about why he deployed Nutanix—simple provisioning and management of servers—and how happy he was with the company’s offering. And he also spoke about how it “just worked,” which sounds mundane but is in fact some of the highest praise an IT pro can give to an infrastructure product. Nutanix worked so well, in fact, that he used it only for its initial intent (deploying and provisioning servers) and didn’t think much more of it.

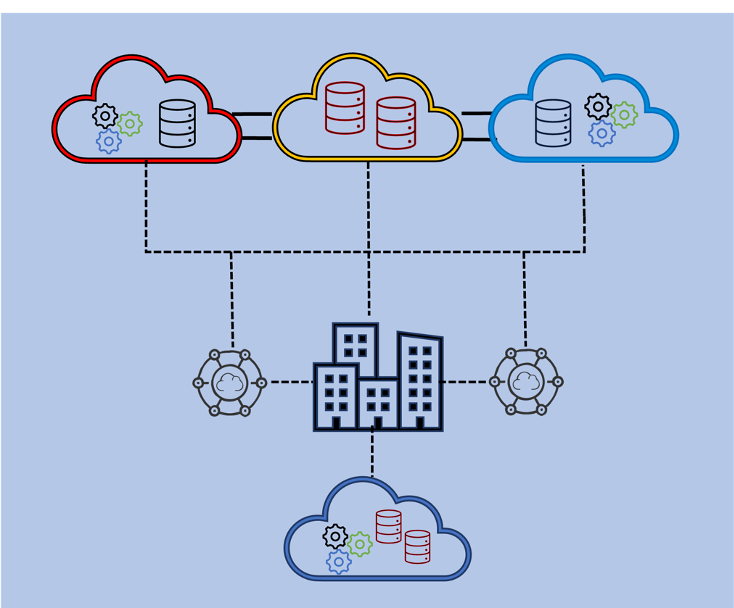

This was perfectly natural back when virtualization ruled the datacenter and the notion of the cloud operating model was exclusive to hyperscalers. Fast-forward to 2024, and the cloud has become integral to IT operations in several ways. Organizations deploy to it, burst it, store data on it, and use it to run their most business-critical apps. And by cloud, I mean clouds. Virtually every organization uses more than one cloud to meet their IT and business needs.

As businesses have digitally transformed and IT operations have had to evolve to support the applications and workloads required for these transformations, Nutanix’s solution has also evolved. HCI today is not the HCI of yesterday. Let me clarify this: Nutanix’s HCI solution of today enables the seamless movement of apps and data from on-prem to multiple clouds—seamlessly, securely, and easily. You can read more about how Nutanix has worked with Intel and HPE to simplify this seamless experience in a research paper I recently authored.

I am not advocating Nutanix as the solution for every organization deploying apps and data across every cloud. But I am saying that Nutanix Cloud Platform is worth checking out if your organization struggles with the management, cost, and operational complexities associated with multicloud adoption.

Partnerships are critical, and Nutanix is good at them

Finding the right partners is the key to successfully selling IT solutions that touch many parts of the infrastructure operating stack. For a solution such as HCI, those partnerships range from technology collaboration and integration to marketing and selling. There are a lot of great technologies and technology startups that never make it simply because of a lack of partners along the route to market. Conversely, there are plenty of inferior technologies that find greater success simply because of their partnerships.

When Nutanix HCI hit the market, it introduced a new category of IT solution. The product, essentially an appliance (Nutanix-branded hardware and software), took off, and the company became a startup unicorn. Meanwhile, established virtualization players were caught flat-footed, allowing this startup to compete for a significant market-share advantage. One couldn’t walk around a conference exhibitor hall without feeling the Nutanix buzz.

A few years later, Dell acquired a significant stake in VMware, and the tide suddenly turned. Was this because VMware had a better solution? Or because the Dell sales team could go into their accounts and offer their clients better pricing and other incentives for switching away from Nutanix? The answer is obvious.

Since then, Nutanix has shifted its go-to-market approach, moving to a software model tightly bundled and optimized with server partners to deliver the best customer experience. HPE, Lenovo, and even Dell have lined up and are delivering joint solutions and marketing/selling campaigns with Nutanix.

A good story about how the Nutanix partnering strategy has taken hold can be found with HPE. As you may know, HPE acquired HCI player SimpliVity back in 2017. This was presumably so HPE could play in the very competitive and rapidly expanding HCI market. As expected, the HPE-Nutanix relationship ended after this acquisition, with HPE viewing Nutanix as a key competitor. After thrashing about for a few years, HPE returned to the table when it realized its customers were continuing to buy Nutanix HCI on HPE servers for the hybrid cloud. Today, we see the two companies collaborating in every aspect of go-to-market.

However, I think the best example of partnering is what Nutanix recently announced with Cisco. Like HPE, Cisco attempted to play in the HCI space with its well-designed HyperFlex product. But the company’s challenges in breaking into a very competitive market (despite Cisco’s size and robust channel) led it to re-examine its strategy.

In 2023, Cisco and Nutanix announced a partnership that led to co-engineered hybrid multicloud solutions. Further, the Cisco and Nutanix sales and marketing teams have been joined at the proverbial hip in driving this solution through the vast Cisco channel. This is an interesting play because it enables Nutanix to tap a much more extensive seller network while allowing Cisco to appeal to a market segment of smaller IT organizations with a lot of potential upside. The partnership between these two is so strong that shortly after the announcement, Cisco announced end-of-life for its HyperFlex offering. Keep an eye on this partnership in 2024 and beyond. I believe it will deepen considerably.

I give these examples to demonstrate the strength of Nutanix’s partner organization, from strategic planning to marketing. The company has more than punched above its weight and is well-positioned in the market because of these partnerships.

The fear around VMware is real

Right or wrong, there is concern about VMware since its acquisition by Broadcom closed. When Broadcom announced its intent to acquire VMware, I was one of the few pundits who thought that the innovation VMware has delivered over the years would continue. And it still may.

However, the new organization has made some head-scratching moves regarding bundled licensing and channel management that are leading many to question what is happening. This is not about a company modernizing its licensing model. This is about disruption of the customer experience and a potentially significant price increase. And this is not merely consolidating channel management; it extends to excluding an indirect sales force—“champions,” as VMware calls them. This is disrupting a channel program that has worked well for years.

How much disruption these moves cause is yet to be determined. The bigger question is whether these are signals of things to come. I don’t know the answer to either question. Nor do customers. However, Nutanix has done a stellar job of capitalizing on these concerns as it continually (and aggressively) attacks VMware. While I’m more of a fan of playing to my company’s strengths and not on the market’s fears, I do see the effectiveness of this approach.

Keys to success for Nutanix

The ingredients for Nutanix’s continued success in 2024 and beyond have been detailed in the previous sections: robust technology; focus on connecting the modern business to the cloud, the clouds, and the edge; and a strong partnership program that traverses the route to market.

If I were in marketing leadership at Nutanix, my plan for 2024 would be to index more heavily on the strengths of my portfolio and the exponential value that my ecosystem partnerships deliver. In particular, I believe the Cisco partnership holds a lot of promise for both Nutanix and Cisco in terms of growth and market expansion.

From a channel perspective, I would build a competitive campaign targeting those VMware champions who may feel disaffected by the company’s recent moves (many of them are already selling the Nutanix portfolio). Anybody who has managed channel sales knows the kinds of levers that can be pulled.

Closing thoughts

It has been fun to watch Nutanix’s journey. My first customer event (.NEXT New Orleans) felt almost like a religious revival because of the enthusiasm of the customer base. I’ve tracked the company form startup to unicorn to a hybrid multi-cloud and HCI market leader. And the customer enthusiasm has not let up.

Things haven’t always been smooth. When the company moved from an appliance model to software and a recurring licensing model, it took a little while for the market to figure it out. Many years later, though, the company and its customers are in a better place.

Nutanix has a unique growth opportunity in 2024 and beyond. That opportunity should come to fruition as long as Nutanix builds and executes a strategy that starts with the customer experience.