Over the last few months, Qualcomm has held two major events to inform the press, consumers, and investors about the state of its business. At its Snapdragon Summit in Hawaii, Qualcomm announced the next generation of its mobile chipsets and automotive solutions, then it followed that up in New York City with its Investor Day. I was fortunate enough to attend the Investor Day, where Qualcomm executives reviewed the company’s progress over the last three years since the last Investor Day it held.

New Products — Mobile and Auto

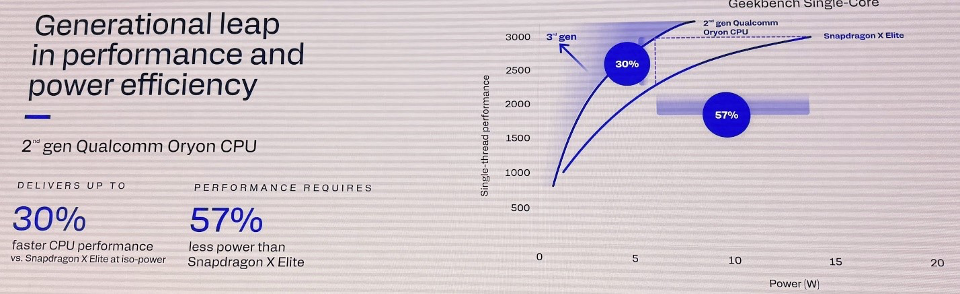

Every year, Qualcomm announces some of its upcoming products for the next year at its annual Snapdragon Summit, usually held in Hawaii. For the latest version of the event, the focus was squarely on the company’s biggest and fastest-growing businesses—mobile and auto. In each case, the big news came in the form of a major update to the CPU architecture thanks to the company’s new second-generation Oryon CPU cores. This marks the first time that Qualcomm has introduced Oryon to its mobile and automotive products, representing significant performance improvements.

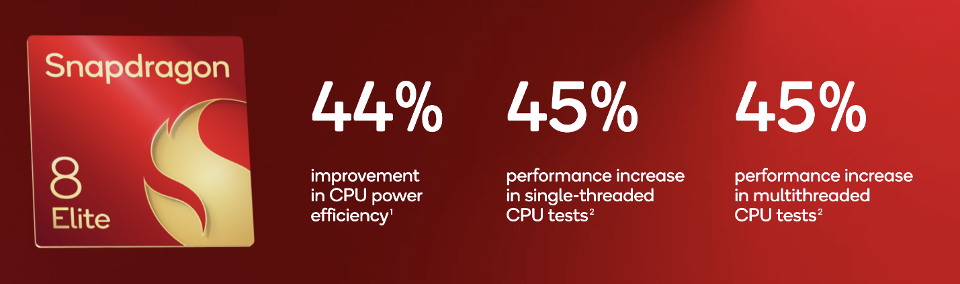

These new high-performance, low-power CPU cores inside the Snapdragon 8 Elite have significantly improved performance over the last generation of Snapdragon 8 Gen 3. This is possible thanks to the second-generation Oryon architecture and a process node shrink, which enables one of the highest-clocked Arm mobile processors in the world—faster even than Apple’s A18 Pro series. Qualcomm claimed that against its own Snapdragon 8 Gen 3, the Snapdragon 8 Elite is 45% faster in single-threaded and multi-threaded applications and 44% better in power efficiency. The Snapdragon 8 Elite has already found its way into a bunch of OEM devices including the Xiaomi 15 Pro, ASUS RoG Phone 9, OnePlus 13, iQOO 13, Realme GT7 Pro, and Redmagic 10 Pro. I expect that it will become the default SoC for flagship Android phones, competing directly with MediaTek’s Dimensity 9400.

On the automotive side, these same cores also power Qualcomm’s new Snapdragon Ride Elite and Cockpit Elite platforms for future vehicles. Snapdragon Ride Elite is Qualcomm’s ADAS solution, which is custom-built using various pieces of Qualcomm IP and is an ASIL-D-compliant architecture. This ADAS platform is part of Qualcomm’s efforts to enable Level 3 autonomy with the potential for Level 4/5 in the future. Qualcomm uses the same SoC to power the Snapdragon Cockpit Elite for infotainment. These chips combine with others for functions including connectivity to create the complete Snapdragon Ride digital chassis solution. This is Qualcomm’s platform for the software-defined vehicle of the future and is at the heart of the company’s strategy in its ever-expanding automotive design pipeline.

Investor Day

Speaking of the automotive design pipeline, Qualcomm updated investors on the progress of its automotive business, including yet another increase in its pipeline—upgrading it to $45 billion. This is up from $30 billion in 2022, showing the continued growth of the business. The company also talked about how it would further lean into its Snapdragon Ride Flex platform, which enables both ADAS and cockpit functions with a single chip for more cost-effective automotive solutions. Qualcomm expects Snapdragon Ride Flex to reach OEM start of production in 2026.

At the event, Qualcomm’s head of Automotive and IoT, Nakul Duggal, detailed that the company expects growth for the automotive business to come from ADAS solutions. Qualcomm then brought out a parade of partners including Mercedes-Benz, BYD, and many others to prove its industry strength among the world’s leading automotive OEMs.

PC and XR Growth Opportunities

During Investor Day, Qualcomm also touted a lot of its growth opportunities in non-smartphone markets such as PC and XR. Interestingly, these two markets are very different for Qualcomm. For XR, Qualcomm has nearly 100% chipset market share, but in a fairly new and small market. Meanwhile, the PC sector is extremely mature in terms of growth, but Qualcomm has a very small market share; it hopes to grow in PCs as that market transitions towards AI PCs and especially Copilot+ PCs.

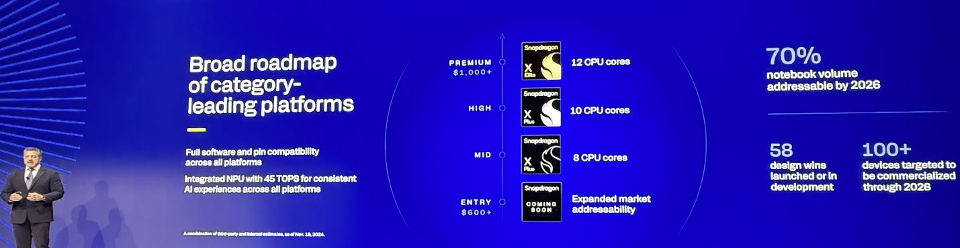

Qualcomm’s Alex Katouzian addressed the AI PC opportunity by talking about the company’s efforts to democratize AI PCs with a new $600 entry point in addition to its existing good/better/best pricing structure for 8, 10, and 12 CPU cores. The company expects to be able to address 70% of notebook volume by 2026 and have more than 100 devices commercialized by then as well. This is part of Qualcomm’s assertion that roughly 100 million laptops per year will be Copilot+-capable PCs priced above $500 by 2029. Qualcomm is confident about its competitiveness in this space thanks to its ability to ship a 40 TOPS NPU within all of its AI PC processors regardless of price. Qualcomm also teased that its upcoming third-generation Oryon CPU will be even more powerful and efficient.

When it comes to XR and spatial computing, the company has dominated the industry and was even at the core of Google’s new Android XR announcement that I recently wrote about. In this market, Qualcomm is closely partnered with both Meta and Google, the only true challengers to Apple’s Vision Pro and XR aspirations. Qualcomm’s view is that XR’s growth—whether in VR, MR, or AR—is driven by generative AI. This aligns with Google’s and Meta’s visions as well. Unlike any of its rivals, Qualcomm can also enable XR growth with its other low-power compute products in smartphones and PCs, which could either act as additional compute or be leveraged to rightsize the chips for the solution. In the bigger picture, Qualcomm is uniquely positioned to take advantage of spatial computing as the next compute platform and to enable its partners to grow in this market.

IoT

Qualcomm has rebooted its approach to IoT many times, partially because of strategic acquisitions like NXP falling through, but also because the IoT market is always changing. To put it more bluntly, the company’s strategy has been all over the place during the 10 years that I’ve covered it as an analyst. But this time around, Qualcomm is focused on what it can enable thanks to AI. This means providing both AI hardware and sensors at the edge, but also solutions that combine them in a coherent strategy. This means bringing together its chipsets, software stack, Qualcomm AI hub, Aware platform, and other solutions in a single approach that has been developed by working closely with partners such as Saudi Arabia’s Aramco. These industrial-grade solutions will deliver up to 100 TOPS of AI performance with the IQ series of products and be edge-AI ready. Qualcomm is also focused on scale, which is one of the biggest challenges in IoT; to this end, the company is working with module makers, ODMs, OEMs, distributors, SIs, and end-user companies across different verticals.

Financials and Outlook

Qualcomm’s CFO/COO Akash Palkhiwala wrapped up Investor Day with a very pointed World Series joke about the people in the room—many of whom came from San Diego or New York City—being united in their hatred of the Los Angeles Dodgers. More seriously, Palkhiwala talked about strong financial growth and execution, as shown by fiscal 2024 non-GAAP revenues being up 9% while non-GAAP EBT and EPS were up 20% and 21%, respectively, over 2023. He also focused on the last five years of growth in those areas, highlighting 2x revenue, 3x EBT, and 3x EPS growth over that same period. He used these as proof that Qualcomm has delivered on its diversification strategy while keeping its core business and growth steady.

Looking forward, Palkhiwala also focused on the automotive sector as a key driver for revenue and profit growth, with an expectation that ADAS will ramp starting in 2026, and the automotive business will deliver roughly $8 billion in revenue for Qualcomm by 2029. He also reaffirmed that PC and XR will also represent larger revenue for the company, with XR alone projected to bring in more than $2 billion in revenue by 2029.

In total, Qualcomm expects that by 2029 its whole IoT business (which by its definition includes PC and XR) will represent $14 billion in revenue, with $4 billion coming from PCs, $4 billion from industrial IoT, and $4 billion from other sources including networking, tablets, headphones, and smartwatches.

CES 2025

At CES 2025, Qualcomm rounded out its Snapdragon X line with its entry-level offering targeted at PCs $600 and up. We also saw Lenovo and Geekom announce Snapdragon X Elite desktops, the first of their kind for the industry, running Windows. The Snapdragon X also delivers on Qualcomm’s promise of maintaining 45 TOPS of AI performance across its entire lineup. This also means that Qualcomm will enable Copilot+ PCs as low as $600 and premium notebooks at lower prices, for example the Zenbook A14, which is ultra-light at under 1kg and features Copilot+ features with an OLED display, 32GB of RAM, and 1TB of storage for only $1,099.

Qualcomm also announced partnerships with Panasonic, Hyundai, Garmin, Leapmotor, and Desay SV for various automotive solutions. These announcements included digital cockpit, ADAS, and digital chassis solutions all around the vehicle. In addition to automotive, Qualcomm also announced an on-premise AI solution for edge AI and IoT solutions using the company’s AI100 accelerator PCIe card.

Considering Qualcomm’s execution and market momentum, barring a global recession I believe its projections to be pretty credible. In my view, Qualcomm’s projections for XR seem fairly conservative, while the company might be a tad optimistic on the PC side—though it could still hit those numbers considering global annual PC volumes. While I do believe that Qualcomm’s competition is fiercer than ever, CES 2025 showed that the company is very much on track to execute its strategy, and I expect that we’ll see even bigger announcements from it later this year.