The tech industry loves a comeback story. Yes, sometimes when leading tech companies start to stumble, we tend to quickly write a company off as past its prime or somehow irrelevant. But as a community we are often too quick to judge. And in the fullness of time, those companies often go in one of two directions. They either regain their balance and become legendary or they falter and are remembered with a tinge of sadness.

Apple, Microsoft, Adobe, and IBM are legendary examples. Each company turned it around when faced with major market disruption to lead again. More than any other factor, market disruption is what keeps senior leadership up at night, whether it’s a new technology (mainframe to PC to Cloud) or business model (open source, SaaS). As Andy Grove, the former CEO of Intel, famously said, “Only the paranoid survive.”

Over the past few months, we have been able to witness two companies that are emerging from their own battles with disruption. SAP and VMware both remain very successful companies, but the fact is they have both been challenged in the age of cloud computing. Cloud is a pretty unique disruption since it is really multiple business and technology disruptions rolled into one. So, I believe that cloud has been far more lethal than previous disruptions such as the PC revolution or the emergence of open source software.

The specific whats or whys of SAP and VMware’s challenges are no longer that important. What is important is that both companies are starting to move forward forcefully. Interestingly, in my view they also are following a similar path. And when you consider that path, it looks quite a lot like what other legendary companies have done in the past. So what is that path, and how are SAP and VMWare going about it?

Step 1 — Lead with Conviction

It takes a very special leader to be at the front of an enterprise-wide transformation. There is just so much baggage from the past. The teams are likely suffering from low morale. Maybe there have been layoffs, or bonuses unpaid. There could be a crisis of faith due to the actions of previous regimes. There may be perceptions from customers, partners, and analysts that are setting a negative tone in the market. In this context, leaders will need to spend a lot of time with many frustrated stakeholders. This requires much more than setting a vision and implementing a new plan. In many cases, the plan will need to break dogmatic principles and heal the company. And no matter what, the leadership team probably has less time than they want to make changes.

It’s a nearly impossible task that requires unflappable confidence and belief in how the company can realign to current and future market needs. And that is what we are starting to see in both of our case studies.

SAP needed to confront the complexity and challenges of getting customers off of their highly customized on-premise platforms. These are upgrade projects measured in years, not months, and frankly they are not instant revenue or profit generators. But SAP needed to confront its past and invest heavily in helping customers move forward with programs like RISE with SAP that use AI technology to help migrate custom code—sometimes decades’ worth of it. It took a while for this to gain momentum, but it is starting to work. It’s working so well that CEO Christian Klein is investing more in these programs this year.

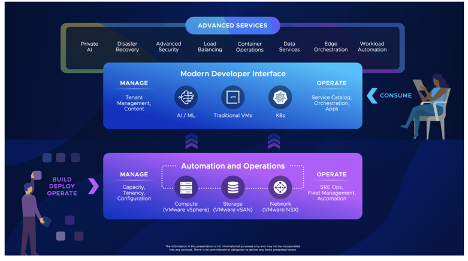

Meanwhile, Hock Tan, CEO of VMware’s new parent company Broadcom, is telling customers that private clouds are the way forward. This is in contrast to the common notion of hybrid clouds touted by almost every VMware competitor. To ensure customers can achieve those benefits, VMware had to admit that its products lacked the integration and ease of use of other platforms—and commit to fixing those issues.

Both courses of action took conviction. Klein’s and Tan’s decisions are strategic and long-term. Also, a good deal of risk comes with these efforts, and the investment community tends to fear risk.

Step 2 — Redefine Great Execution

The reason big companies get so big is often a function of their great execution. Yes, when a market is new, it’s all about the technology and satisfying early adopters. But once the technology tips into the mainstream, execution and scale take over. Can you deliver on time? Can you meet your sales forecasts? And so on. The typical challenge is that all of the business infrastructure and staffing for great execution is also resistant to change because it worked so far. Therefore, when a market disruption happens, it is typically much easier (and cheaper) to apply bandages to the existing processes than transform them to truly meet market needs.

Nowhere does this band-aid issue show up more than when a company elects to grow via acquisition. The truth is that, as a company gets better at execution, innovation often becomes more incremental and focused on existing products. The company is more concerned with “feeding the beast” than taking new risks or tackling new areas of discovery and product development. So, to keep up with the market, companies buy their way into continued product relevance. But again, if you don’t do the work to integrate acquired businesses and their technologies into the whole, you start to suffer.

When a market disruption happens, the band-aid approach will work only for a little while. To climb out of a disruption, you need to rethink your products, your go-to-market motions and especially your business infrastructure. And that cannot mean just cutting budgets (and staff), with execs saying “We need to do more with less.” It has to run deeper than that. To their credit, it seems that our case-study companies are genuinely trying to reinvent their businesses rather than merely patching their external and internal processes.

It’s clear that these days SAP is engaging more actively with cloud companies to enable customers more choice for how to deploy and integrate SAP products. This is in addition to setting a more ambitious product roadmap for its Business Technology Platform integration technology. These actions are covered in more detail in our recent overview of SAP’s earnings and our deeper dive into the themes of SAP’s annual Sapphire conference. SAP is also aggressively trying to help customers move to its new cloud-based platforms, which will allow for faster and much smoother upgrades in the future.

VMware is taking a different route by adjusting its product portfolio. But like SAP, the goal is a more streamlined and improved customer experience. Taking this approach will simplify the go-to-market strategy and enable easier customer adoption. Recently, VMware announced VMware Cloud Foundation 9, which is the cornerstone of a greatly simplified and more cohesive product strategy. There will be four core VMware products that will also better reflect customer needs, along with add-on technologies for customer- or industry-specific requirements. For more details, check out my colleague Matt Kimball’s analysis on VCF 9.

These are just some of the outward-facing transformations that each company is making. There are certainly additional internal changes that have not been announced. It is important to recognize that these changes also come with a cost—both financially and from a people perspective. I do not want to minimize people losing their jobs, which is an unfortunate byproduct of these types of transformations. That said, I am hopeful that the leadership at both of these companies can realign their execution abilities well and start hiring again. I believe that this step is the biggest and most important part of the transformation process.

Step 3 — Follow a Pragmatic Strategy

When Lou Gerstner took the CEO role at IBM in 1993, the company was in dire straits. He once famously replied to a journalist asking about IBM’s strategic vision: “The last thing IBM needs is a vision.” At the time, this was a controversial statement. Gerstner understood the common fallacy in times of transformation that a great strategy or vision is some kind of silver bullet that will rally a company back to success. This is only sometimes true. And Gerstner proved it by steering IBM through a series of tactical and culture-bending decisions.

Don’t get me wrong, some kind of strategy is required, but it does not have to be grand or visionary. At first, the strategy must be pragmatic and achievable. It must address the main threats to the business and prove to all of the stakeholders that this time, these changes will stick. In a lot of cases following a disruption, the strategy needs to initially focus on how to handle a shock to the revenue trajectory. It is hard to rebuild if the foundation is not stable, and each of our case-study companies is fortifying and expanding existing customer spend.

SAP is honing its value proposition for improving business processes and continuing to be a trusted platform upon which to operate a business. And while there have been many SAP announcements about AI recently, all of those announcements have been in service of how AI will enhance SAP’s various products to improve that core value proposition. So, while there is certainly some innovative technology involved, the real message is that SAP is doing what it takes to live up to an established brand promise.

VMware is doing something similar in that its product strategy is not chasing current market trends. The primary message at last week’s VMware Explore event was simplification and execution across the portfolio, not glorifying the latest GenAI innovation. AI is in some of the product offerings, to be sure, but the overall approach is in contrast to competitors that are leading with AI. Instead, there is more focus on products working well together and aligning with current customer needs, versus acquiring or building some new visionary technology. To put it another way, VMware wants to justify its premium price and positioning by delivering the best products—not the shiniest new objects—for its core users and customers.

Both of these are strategic notions. They are just not particularly flashy. Notably, they also align perfectly with steps 1 and 2 in this process explained above. Both of these companies need to establish a new cadence in markets that look different from when they reigned as the benchmark companies against which others in their categories were compared. The best way to do that is to prove it—in practice, in the real world, with paying customers.

What Customers of Turnaround Companies Should Do

None of us really knows how these transformations will work out in the fullness of time. But at this stage, what is important is that each company is following a template that has worked well in the past. That alone is impressive. As someone who is a veteran of multiple transformations to operating divisions and entire enterprises, I know the tasks outlined here are easier said than done.

If you are a customer or partner of these companies, here is what I would suggest:

- Be patient — It’s always bittersweet to hear an admission that some features have been a long time coming and are still on the roadmap. But simply knowing that they are now actual priorities is a small victory. And while it may take time to get what you want, you at least know for sure that the highest-level leaders are actively monitoring progress.

- Be vocal — Now is the time to take part in advisory boards or meet with product leaders to give your feedback and thoughts on the future of your relationship. And also feel free to ask or negotiate about what resources are available to help you get back on board. Both SAP and VMware are investing to retain you.

- Be open-minded — Product packaging may change, and you may need to consider increasing your spend to get everything you want. My suggestion is to not react emotionally to the changes. Take your time and be clear on what your needs are for your specific situation. Leave it to the vendor to try and solve the problem for you. If they can’t meet those expectations, that becomes a different sort of discussion.

My colleagues and I have lots of connections at these companies and among their customers. It’s worth mentioning that both SAP and VMware are our clients, too. So as these transformations unfold, my colleagues and I will continue to monitor these comeback stories closely—and I’ll report my findings here.