QUALCOMM

Qualcomm is a semiconductor company best known for its efforts in the realm of smartphone connectivity with its popular Snapdragon brand of modems, application processors and now RF. While smartphones are undoubtedly the company’s bread-and-butter, Qualcomm plays significantly in a number of other areas. A great example of this is its $6.5 billion (backlog) automotive business. I gained a lot of insights into Qualcomm’s automotive strategy at its 2019 financial analyst day earlier this year—today I wanted to share some of my findings.

Qualcomm CEO Steven M. Mollenkopf kicked off Qualcomm’s analyst day by discussing cellular connectivity—in particular, how it has disrupted and continues to disrupt the automotive market. 4G, in particular, began to open new doors for car systems, enabling telematics and allowing automakers to connect to the Internet for the first time.

While the automotive industry is a well-established one, with entrenched industry players and supply chains, introducing connectivity into the mix gave new players like Qualcomm a crucial window. In addition to the new demand for modems in vehicles, the ways consumers interface with their cars are increasingly modeled after and driven by the way we interact with our smartphones. The cockpit has undergone a huge digital transformation over the last decade. This means demand goes beyond modems and into other computing elements—areas where the traditional players in automotive simply don’t have the IP to be competitive. I believe companies like Qualcomm have an immense opportunity here.

QUALCOMM

James H. Thompson, Qualcomm’s CTO and executive VP of Engineering, took over from there to explain how the company leverages R&D and its pre-existing portfolio to address automotive needs. According to Thompson, every one of Qualcomm’s adjacent businesses leverages technology it initially developed for the smartphone. He explained that its telematics offerings, derived from its Modern-RF system, as an example of how the company pre-plans for cross-market utilization. Qualcomm integrates Ethernet into its modem designs even though mobile does not call for it—which should make them more easily leveraged in automotive. This also allows the company to take advantage of the manufacturing scale it already has in mobile.

Then there’s automotive infotainment: the software and hardware systems that provide operators of the vehicle with audio/video entertainment, navigation, information, and more. In this area, Qualcomm leverages technology derived from its Snapdragon Mobile Platform to provide synchronized multi-display capabilities, instrument cluster support, multi-OS support, automotive safety support, GPU context switching, support for surround view HDR cameras, and more. Qualcomm says it is leading almost everyone on the high-end infotainment systems thanks to the strength of its application processor technology. With 19 out of 25 global automakers currently utilizing Qualcomm’s Snapdragon Automotive Infotainment Platform, the company claims it is #1 in number one in premium, next-gen infotainment design wins for production cars starting in 2020.

QUALCOMM

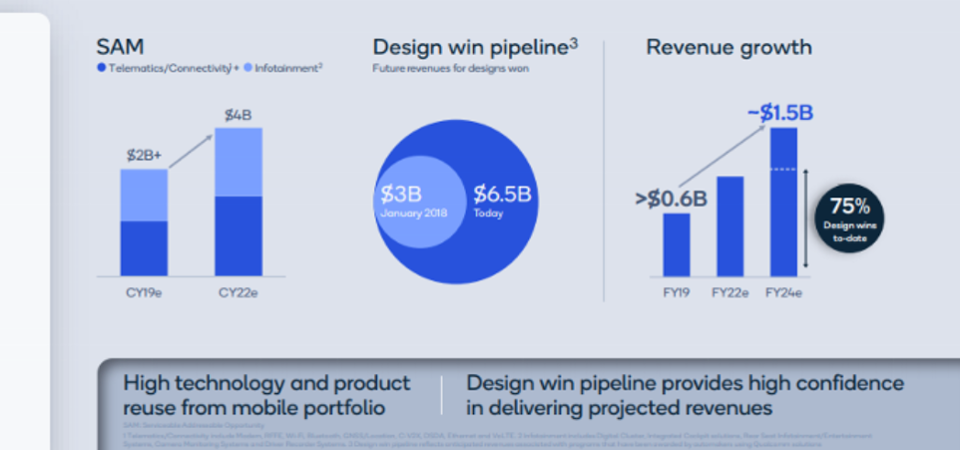

Telematics and infotainment, together, account for a projected $4B SAM by 2022 for Qualcomm and 75% of its automotive revenue in fiscal 2024 is already locked down with existing design wins, making for a stable business for years to come. These numbers are set to grow even more substantially though, as the company makes inroads in ADAS, or Advanced Driver-Assistance Systems. These systems, designed to make cars and roads safer, are becoming more and more sophisticated as the industry trends towards autonomous vehicles. Thompson touted Qualcomm’s power-efficient neural processing capabilities as a differentiator, since active cooling for automotive is expensive and not ideal.

Qualcomm estimates that ADAS represents another $5B SAM in 2024. In addition to ADAS, Qualcomm says it is going after the $13B Cloud/Edge AI market, also reutilizing its technologies developed for mobile to give it a head start.

With advances in cellular connectivity and digital transformation of the cockpit, Qualcomm really is in right place at the right time. Its mobile technology appears highly adaptable to these new automotive use cases, which likely puts it ahead of the traditional leaders in the space who lack the necessary IP and technical experience to stay abreast of these changes.

One thing Mollenkopf said stuck out to me—while auto is really the first big industry to be disrupted by advances in cellular technology, it won’t be the last. I expect Qualcomm, with its vast mobile IP portfolio, will be similarly well-positioned to take advantage of this transformation in other established industries.

I’m looking forward to see if or what automotive announcements Qualcomm has in store for CES 2020.

Patrick founded the firm based on his real-world world technology experiences with the understanding of what he wasn’t getting from analysts and consultants. Ten years later, Patrick is ranked #1 among technology industry analysts in terms of “power” (ARInsights) in “press citations” (Apollo Research). Moorhead is a contributor at Forbes and frequently appears on CNBC. He is a broad-based analyst covering a wide variety of topics including the cloud, enterprise SaaS, collaboration, client computing, and semiconductors. He has 30 years of experience including 15 years of executive experience at high tech companies (NCR, AT&T, Compaq, now HP, and AMD) leading strategy, product management, product marketing, and corporate marketing, including three industry board appointments.

- Patrick Moorheadhttps://moorinsightsstrategy.com/author/phfmphfmgmail-com/

- Patrick Moorheadhttps://moorinsightsstrategy.com/author/phfmphfmgmail-com/

- Patrick Moorheadhttps://moorinsightsstrategy.com/author/phfmphfmgmail-com/

- Patrick Moorheadhttps://moorinsightsstrategy.com/author/phfmphfmgmail-com/