Recently, I met with someone in the VC community who asked me if there was an easy rule for predicting which jobs would be impacted by generative AI. My response was that in its current state, any job with “a lot of words” was likely to be impacted in some way. This is of course a broad characterization but, if you consider tasks such as transcription, application development, consulting and also industry analysis (gulp, like my work), the impact of generative AI is already being felt.

Consulting and global systems integration firms (think IBM, Accenture, Wipro, Deloitte etc.) are at particularly interesting inflection points. These companies carry tens of billions of dollars of annual revenues and hundreds of thousands of employees, and they measure success by maintaining acceptable gross margins. These firms tend to specialize in projects such as application modernization and business process automation—the exact projects for which AI vendors are quick to demonstrate how easy generative AI can be. So, for these firms it is a “double disruption” to both the value they deliver and how they operate. To their credit, these firms are already readjusting to leverage generative AI to help clients globally. IBM Consulting is an interesting case study to understand what’s happening in this massive ecosystem.

The AI Consulting Market Opportunity

Last month, Mohamad Ali, who leads IBM Consulting, addressed a group of analysts in New York. In his comments, he mentioned that the total addressable market for consulting services is growing. A quick review of different market research sources confirms Ali’s assessment. However, it’s important to note that the growth is relatively slow, with most publicly available figures in the 5% to 10% range annually. On its face, this sounds like good news, considering that the disruptions coming from AI could flatten or shrink some markets.

However, TAM is a misleading measurement when considered by itself. In a market with 5% to 10% growth, firms need to not only compete but also compete efficiently. With generative AI, the opportunities for efficiency are significant, particularly since consultants are known for the sheer amount of words they produce. And, honestly, LLMs have already improved to the point that their augmentation of the human services being delivered is profound. To win in the consulting/GSI space, the most competitive firms will need to leverage generative AI—and not just for service delivery, but in their go-to-market strategies and ultimately their business models.

Disrupting Service Delivery with Gen AI and Agentic Applications

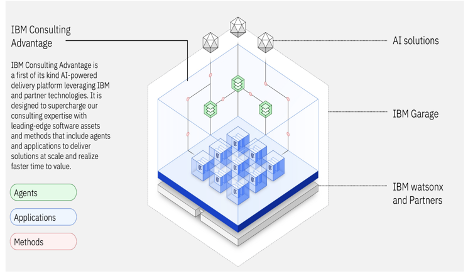

This brings us to IBM’s announcement of new capabilities in its IBM Consulting Advantage platform. Consulting Advantage is an online platform that offers hundreds of generative AI-based agents to assist IBM’s consultants with a wide range of tasks. AI-based agents are quickly emerging as a way to automate and reimagine business processes by embedding AI capabilities into an application. An agent is distinctive in that it is a composite and autonomous application that enables humans and AI to collaborate to complete a task. Agents are different from existing AI-assisted copilots or chatbots, which aren’t as sophisticated. For instance, an AI agent will be able to take further actions based upon the results of the LLM response, with or without further human involvement.

The agents in Consulting Advantage are developed and trained by domain specialists (from IBM and in some cases its partners like SAP), who have grouped them into collections oriented around specific activities. Examples include project delivery (“Test and document a set of application code”) or selling (“Build a project proposal for a client based upon all existing proposals and past projects”).

IBM is not alone in building out these tools. In fact, I was given a demo of what Deloitte is using earlier this year. But it’s not the specific platform that’s important. What’s important is recognizing that generative AI is a catalyst to drive more competitiveness—and taking action early to get ahead.

Will New Agentic Platforms Disrupt the Consulting Value Proposition?

A critical factor for developing a go-to-market strategy is the overall strength of the firm’s value proposition. What is the key customer benefit provided, why is it different from what competitors offer and what is the firm’s ability to deliver the promised value? It’s very easy for technologists and technology companies to overemphasize technology or products in a value proposition. And that is a fatal mistake.

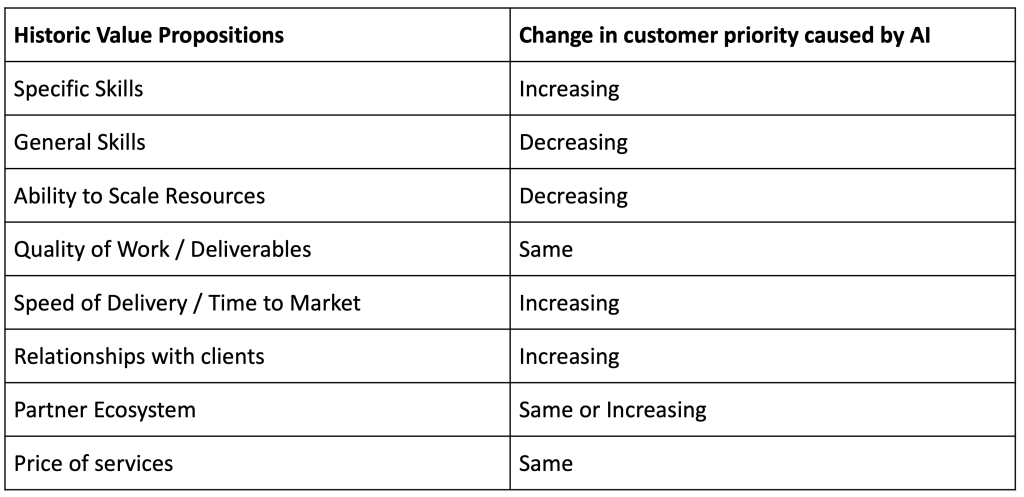

The reality is that the best technologies or outcomes don’t always win. There are many other crucial factors of value propositions such as pricing, ecosystems and alignment to specific requirements. But the trick for vendors is to remain aware as markets evolve: Will the existing value proposition still resonate? Or will it need to evolve as well? I think that generative AI will be a forcing factor in the evolution of value propositions for consulting and GSI firms.

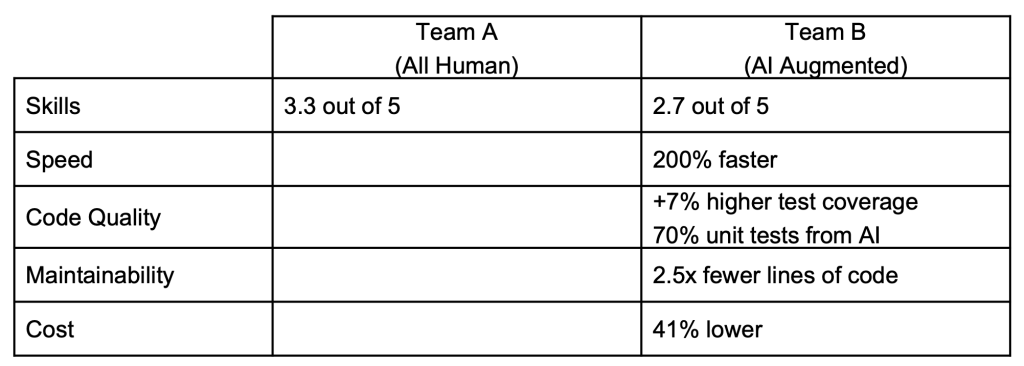

As you can see in the chart above, AI agents should increase the ability for consultants to be more productive and scale up quicker for common and sizable projects. This is driven by the scale of AI agents specifically and generative AI in general. This could also be compounded by some metrics that suggest that lower-skilled resources should be enabled by agents to do more complex tasks. In fact, IBM has done some benchmarking on this topic, and while the change is currently slight, there is an expectation that AI will further decrease the skills gap—as shown in the chart below (adapted from a slide at the IBM Analyst Summit).

While the above changes could prompt firms to compete more heavily on price, I am not sure that will happen. AI also provides opportunities for firms to increase other value drivers. For example, new solutions delivered more quickly will also potentially speed up the client business case for that solution. A revenue-generating application or service that achieves a faster ROI will be more highly valued. Additionally, a firm’s ability to cultivate a deeper understanding of the client’s objectives, strategy and unique requirements should also lead to increased quality and higher client loyalty. Therefore smart consultants driving advanced AI agents could yield increasing rather than decreasing project fees.

AI Will Shake Up the Business Model

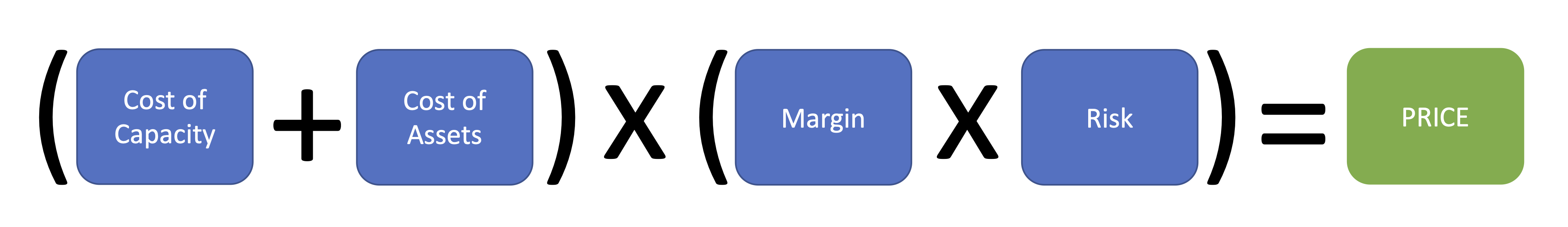

In addition to reassessing value propositions, firms will also need to reconsider business models. Something else that stood out from Ali’s comments was that customers have begun to expect AI to be built into their project—and they do not expect to have to pay for it. I can appreciate that point of view, given that the consulting business model has been based primarily on human productivity and has been relatively stable for a while now. But AI for free does not conform to reality. To truly understand what may need to shift, let’s consider the historic business model for a consulting project, as represented in this quick diagram I made:

The cost of capacity has always been the major factor since people and time are limited resources. To help increase productivity, firms have licensed or built consulting assets from previous efforts. However the price of assets has often been used as a lever to compete since the cost of creating the assets was typically covered on a previous engagement. In some ways, this was like the early era of IT when software was “given” away to help win hardware deals. That notion may sound crazy today, but it’s something IBM knows about from the mainframe years. Fortunately, IBM and other firms very smartly abandoned that practice a long time ago. Another confounding factor has been project risk. Project risk can manifest in the form of the type of contract (fixed fees versus time-and-materials) or the nature of the work.

Agents introduce many ways to tweak the existing model. For instance, AI will decrease the cost of human delivery capacity but it should also increase the cost of assets. (This is because AI agents need to be constantly updated and trained by someone who is highly skilled, and the agents have to run on expensive AI infrastructure.) Additionally, AI should be able to reduce project risks—but again that will require constant improvement on assets.

So for all of this to work and not become commoditized, margins on the assets must improve, since they scale better than people. Additionally, if agents reduce project risk in a meaningful way, then margin tolerance can change.

The net of this is that the consulting business will need to evolve away from focusing on people and hours and toward providing access to AI agents that reduce project risks. I am sure that every firm will elect to handle this in different ways depending on its capabilities and margin tolerance, but I am also sure that while AI will be “built in,” it will not be “free.”

From Chaos, New Strategic Opportunities Arise

While all of these AI-driven disruptions may seem like a daunting transformational task for consulting and GSIs, I also see new possibilities. For instance, consider the following.

- Service firms will become almost indistinguishable from software companies — Many next-generation consulting assets will be in the form of AI-based agents or deterministic robotic processes. These new assets will be more like fully baked software products, in contrast to earlier assets, which were 80% complete solutions developed across prior engagements that required 20% unique customization for each client. LLMs and agentic applications have special capabilities such as context and memory. This means that agents running in platforms such as Consulting Advantage will be like the agents being built into Salesforce or ServiceNow.

- New career paths — Highly skilled consultants at service firms sometimes encounter a career ceiling if they are not able to drive sales or manage significant client relationships. However, hyper-skilled domain experts will become more valuable and scalable if they can master devising and scaling AI-enabled project delivery. This is similar to the engineers who pioneered infrastructure and operations at the hyperscalers during the early days of cloud computing.

- New pricing models — While agents and AI are infinitely scalable in theory, there are limits. So, you may see instances where firms can charge something like “surge” pricing. For example, when there is high demand or a desire to speed up project velocity, that could influence pricing. That also likely means you’ll have some clients that are willing to execute some work slower to save money.

All in all, while I do think that those of us who spend a lot of time in words will be impacted by AI, I am fairly confident that large consulting firms and GSIs can survive and even thrive in the new world. All they have to do is be as successful transforming themselves as they have been with countless clients.