Technology practitioners tend to think of market shifts in terms of whichever technology is dominating the current cycle. Right now it’s all about generative AI; ten years ago it was all about the cloud. But what if you are in a technology-adjacent role? For example, do HR and finance people see market shifts the same way techies do?

Someone Has To Account For All Of This Innovation

The answer to the above question is pretty much no. This comes to light when you speak to the finance people who work with IT departments. Over the last 10 to 15 years one of the shifts that they will talk about is in pricing metrics. The movement to open source and cloud technologies led to a big shift in how enterprises manage and account for costs.

More often than not, that big shift has been figured out and managed using spreadsheets, which, although cheap, can be prone to human errors and a challenge to maintain. Frankly, the importance of maintaining the IT budget spreadsheet has elevated it from a simple file to a business-critical data repository.

And it’s not just the rows and columns of a spreadsheet that are crucial. Graphs and charts to summarize the complex data have become something of an early (or sometimes too late) warning system for busy executives. When something in the chart flips from green to red or crosses over some baseline metric, that is typically when deeper inspection of the numbers begins. These spreadsheets and associated graphs and charts are going to need another overhaul very soon. Trends like serverless computing, generative AI and agents are starting to introduce even more pricing models for enterprises to deal with, further complicating the financial picture. Maybe now is the time to really start thinking about FinOps.

Getting Started In FinOps

The familiarity and low cost of managing via spreadsheets makes that practice very sticky. Staying with that approach is even more appealing when you look at the market for FinOps technology. Given the depth of features, FinOps platforms can seem like something suited only for the Fortune 100. In that context, there are also natural concerns about the change management efforts that would be required for integration and deployment. But IBM and Apptio see things a bit differently.

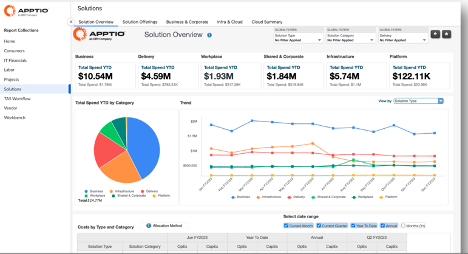

IBM acquired Apptio in 2023 after that company had racked up years of success in creating a platform to help enterprises deeply understand IT costs and optimize IT spend. The Apptio platform has a set of powerful capabilities that can be highly customized to meet specific business and technology requirements. Even better, in the year since the acquisition there have been significant efforts to align Apptio tools with other IBM products including Turbonomic and Instana. If this sounds complicated and expensive—well, it could be, even if it’s not at the Fortune 100 level.

Apptio’s New Foundation — Apptio Essentials

Now, however, IBM is rolling out a new variant called Apptio Essentials. The notion behind Essentials is to help companies leverage foundational features to improve financial planning and more deeply understand their spending. In addition to modules for costing and planning, there is also a billing module coming soon to help with things like chargebacks.

Apptio Essentials is meant to be a great way to start out in FinOps and grow over time. Crucially, it’s not a different code base than the full-service Apptio product, nor is it a special subset of SMB-specific functionality. The key difference from the main product is that Essentials places limits on configurability, customization and integration. For example, the cost module only integrates with your existing general ledger, unlike the full-featured version of Apptio, which can connect to many data sources. Also, the benchmarking information included in Essentials is based on market averages rather than being specific to your company. Because of its limits, you can be up and running on Essentials quickly (30 days is the goal). And if you want to upgrade later on, that’s a simple process rather than a whole new implementation.

Why Do It This Way?

By moving you away from management by spreadsheet, Apptio helps you align your operations to market norms, and it provides insights about where savings might lie. If that’s all you need, that’s a fine value proposition in itself.

But IBM is also betting that you will see a real transformation opportunity when you consider how you could integrate some of IBM’s other offerings including Cloudability and Targetprocess. For example, with Targetprocess you can start to see how well software teams are performing and gain insights into changing development methods. Insights like these are worth a look because they can feed a genuine process of digital transformation to enable a more collaborative and opportunistic business model.

I think that IBM’s approach with Apptio is refreshing because FinOps has long been a two-class market. Traditionally, there have been those with the resources or vision to deploy a proper toolset, and then there have been those that have chosen to get by with spreadsheets. But given all the changes in the IT landscape, it’s time that everyone in the second group got an upgrade.