I have been in and around the PC market for nearly 35 years, working at system houses, chip vendors that cater to those companies, and now as the head of a technology industry firm covering the PC market. Working for PC makers and chip companies, I spent my time leading product management, product strategy, product marketing, and even channel marketing. This hopefully establishes my credibility to use the headline on this piece, because Qualcomm has done something truly remarkable.

In this analysis, I want to discuss just how difficult Qualcomm’s accomplishment was, explain what exactly it accomplished, point out a Qualcomm player who you may not have heard about, and discuss what Qualcomm needs to do in its next act.

Qualcomm’s Journey to the PC Market: A Long and Hard Road

By my count, since the inception of the personal computer there have been at least twenty different processor companies that tried, and mostly failed, to gain traction in the PC market. Many of these, surprisingly, were X86 vendors that IBM brought on as second-source manufacturers behind Intel. Intel continues to dominate this market, and AMD has been the only sustainable competitor at around 20% unit share.

Many mistakenly think that Qualcomm’s first foray into the PC market came in 2017 with the Snapdragon 835. In fact, Qualcomm’s first processor for Windows RT was the Snapdragon S4. That processor was used in several Windows RT devices, including tablets from Samsung and Dell, which were unveiled in 2012. The systems were underpowered, and users did not care for the limited operating system. Windows RT died an ugly death, and the Qualcomm development program was discontinued.

The Snapdragon 835 was based on the same architecture as Qualcomm’s smartphone processors and aimed to bring the benefits of mobile computing to the PC space. True to form, these platforms had exceptional battery life and connectivity. However, the Snapdragon 835 and its successors, the 850 and the 8cx, faced several challenges in gaining traction in the PC market. First, they had to compete with the dominant players, Intel and AMD, who had decades of experience and expertise in the PC space. Second, they had to overcome the compatibility and performance issues of running Windows on Arm, which required emulation for most legacy applications. Third, they had to convince both the PC makers and consumers that Qualcomm could offer a compelling value proposition that justified the premium price of its processors.

Qualcomm’s breakthrough came in 2021, when it announced the acquisition of Nuvia, a startup founded by former Apple engineers who had worked on the latest M-Series chips for the Mac and the iPad. Nuvia had been developing a custom CPU core for servers called Phoenix, which promised to deliver industry-leading performance-per-watt. Qualcomm decided to leverage Nuvia’s technology and talent to create a new PC processor, the Elite X, that would challenge the best offerings from Intel, AMD, and Apple.

Qualcomm deserves credit for having the foresight to acquire Nuvia versus building from scratch as Qualcomm previously had with its own custom cores. Of note, no other startup chip companies I have tracked ever sold before tape-out of their first chip, so as far as I know Nuvia is alone in achieving this.

Previously Impossible: Morphing Server Processor IP into Competitive PC Chips

It’s one thing to acquire IP for server SoCs with a small team, but it is a very different thing to morph it into a notebook PC chip and platform that’s competitive, if not even dominant. Notebooks run off batteries with small or no fans, in thin form factors, where milliwatts matter; by contrast, server racks run off kilowatt power supplies and generate a ton of heat that requires giant fans in tall racks. (Take my advice: Do not get stuck in the hot aisle.) I am very surprised that Qualcomm delivered a server IP-to-notebook part and platform this quickly as it is very, very hard to do. It also took an army of Qualcomm engineers.

I won’t drill down into all the benchmark glory as many reviewers and as Signal65’s Ryan Shrout reported ahead of the official announcement. (Disclosure: I am co-founder of Signal65.) What I do need to say is that Qualcomm pulled off a miracle with its leading battery life, multi-threaded CPU, and AI performance. Qualcomm did what it said it would do. Impossible—at least before now—and impressive.

Qualcomm’s Design and Platform Wins

Having solid IP, architecture designs, performance, and battery life is great, but what about getting design wins at OEMs? I used to see this day in and day out at AMD, which had some exceptionally good tech, but still sometimes had difficulty getting assorted.

With Snapdragon X, this was Qualcomm’s third or fourth time at bat in the PC market, and from my point of view, it was its last chance to make something happen. PC manufacturers make very little money and are very risk-averse these days, as most of the PC value chain profits go to chipmakers AMD and Intel, Microsoft for Windows, and productivity apps. OEMs make platform profits in enterprise, gaming, and premium consumer laptops, but most of their profit dollars are on post-sale services.

To my amazement, Qualcomm secured design wins at what I consider every volume Windows notebook maker: Acer, Asus, Dell Technologies, HP, Lenovo, Microsoft Surface, and Samsung. Microsoft shifted its entire consumer line to Snapdragon X.

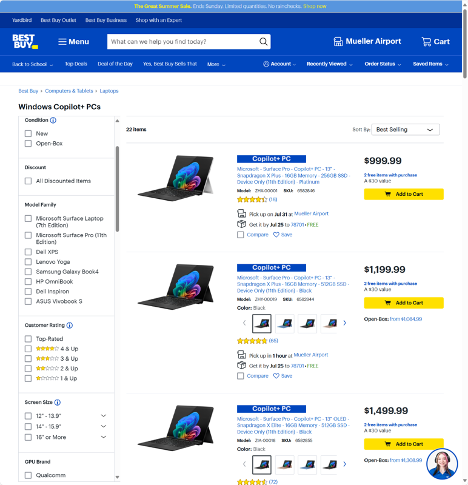

Design wins don’t always mean commercialization, however. The OEM might decide that the risk is too high and pull the product back, or it might limit risk to one region as it kicks the tires. Or it might limit the chip supplier to consumer-only SKUs. Yet in the case of the huge launch of Copilot+ PCs, OEMs went all in with 23 unique platforms spanning consumer, commercial, and even enterprise. Most surprising were the commercial SKUs that came from Lenovo with ThinkPad, Dell with Latitude, and HP with the EliteBook brands, all targeted at the most difficult and demanding audience: enterprise IT, with its extra needs for longevity and security. The breadth of the offerings indicates that OEMs had confidence in Qualcomm and the unique value proposition it could deliver.

The Channel

So again, it’s one thing to have good IP, architecture, performance, battery life, designs, and design wins—but will the channel assort them?

No matter how good the OEM design and platform wins are, unless your chips are distributed through channels so people can buy the notebook, all that goodness is for naught. As with designs and platforms, OEMs typically try to limit their risk by limiting distribution. This is not just about having what the channel thinks is a unique value proposition, but about cash and investment, too.

Qualcomm and its partners appear to have assorted the Snapdragon X platform across 45 consumer channel partners in 20 countries and 25 commercial channel partners in seven countries. It was good to see Snapdragon X on the CDW and Ingram Micro websites. These outlet numbers are broad, and I would say it is a particularly good start.

These extended partnerships and contracts take an incredible amount of effort and could easily take years to form. It didn’t take Qualcomm years. Some people mistakenly think that channel partnerships are just about money and writing big checks. Yet the channel makes even less money than the OEMs, so the channel needs to see a potential for long-term success versus a “one-and-done” proposition. In this case, that means the channel must see promise in the long-term value proposition of Snapdragon X, Qualcomm, and its channel partners’ ability to increase their profits.

While it may sound like I am talking out of both sides of my mouth, in the beginning vendors do have to invest competitive funds into the channel, and even more so as a percentage of revenue. This isn’t just because the channel wants to maximize marketing funds, but also because these investments prime the pump for future success. Qualcomm, to its credit, funded the channel to get the OEMs assorted in consumer and commercial channels. Microsoft is also investing.

Unsung Leader: Kedar Kondap

Qualcomm pulled off the impossible, and in a market that has had 10x more processor company failures than successes, to create a very unique and competitive value proposition that resulted in design wins and platform wins across every major Windows notebook maker. Better than that, it delivered on the promises made in spectacular fashion with the review community. For the first time, someone created a notebook chip that is truly competitive on performance per watt with Apple’s M3.

To pull off a miracle like Snapdragon X, it takes a village. It requires engineering, operations and supply chain, finance, marketing and communications, and sales to pull off something like this. Everyone at Qualcomm who was involved deserves kudos.

I don’t normally call out executives, but I will here because the feat was so large. Kedar Kondap is the senior vice president and general manager of the compute and gaming group at Qualcomm. The buck stops with him on the degree of success for Snapdragon X. I spent many years in general management functions like his, and there’s not a lot of glory in those roles, except that they are an onramp to higher levels of leadership. In general management, without many direct reports or resources, you have to pull together the same functions just mentioned—engineering, operations and supply chain, finance, marketing and communications, sales—into one cohesive team, execute, and make sure the program hits its revenue and expense targets.

Kondap does not get on many public stages or do many public interviews, but he and his very small team deserve a lot of credit for what they have accomplished. Not too long from now, Qualcomm’s PC business could be in the billions of dollars of annual revenues, if it is not already. As a side note, it must be a rush for Kondap to compete head-on with his prior employer, Intel, where, according to LinkedIn, he worked from 2000 to 2007.

Mission Accomplished?

The Qualcomm PC mission is not yet accomplished.

The first next steps are to drive sales from those channels. I have visibility into the U.S. consumer channels, where I am seeing positive feedback, but I will await the official sale-out firms like GfK to render the initial verdict on the launch volumes globally. I am expecting small numbers at first given small sell-in, but I cannot see why Qualcomm couldn’t garner 5% of the premium Windows consumer notebook market for December 2024. Market-share gains take time, and confidence in sell-out will only motivate more sell-in and sell-out. It should be noted that regardless of how large the business is or ends up being, this is all upside for Qualcomm. While there are extra things you need to invest in to create a competitive Windows notebook platform versus a phone, tablet, or car, the IP leverage is extensive.

Meanwhile, both Intel and AMD are looking for paybacks with their lower power, higher performance, higher AI TOPS designs for the holiday selling season. So no one is going to simply hand over market share to Qualcomm.

I have had meetings with the most senior leaders of the largest PC manufacturers and the consistent message is clear. They love what they got with Snapdragon X, believe this is the first notebook platform to compete with Apple M3-based MacBooks, and want Qualcomm to offer top-to-bottom PC lineups into desktops and at lower price points.

OEMs want a third, credible vendor with scale to maximize profits across more platforms and designs. We have seen lower price points with the Snapdragon X Plus that were still in the premium price band, which was a good start and perfect for sticking to the positioning, but OEMs want more mainstream price points. As for new form factors, we saw a hint of that from Qualcomm CEO Cristiano Amon at this year’s Computex, where he showed an image of Snapdragon X Elite-based all-in-ones and mini desktops and declared that the platform is “coming to all PC form factors.”

In my nearly 35 years in and around the PC industry, there has never been this level of competition and innovation. There are now three credible Windows notebook PC processor companies investing billions to compete hard, and the end users are being rewarded with thoughtful and price-competitive notebooks.