While earnings don’t always reflect a company’s success in executing its strategy, they are certainly helpful for analysts. They demonstrate whether products and solutions are seen as useful and valuable to the market.

Pure Storage, a data management company that has changed how enterprise IT consumes storage, recently announced its quarterly earnings. We have seen its strategy validated again after a strong showing. While AI is undoubtedly a driving factor in the company’s continued growth, I believe there are additional elements to how Pure approaches storage and data management that fuel loyalty and an increasing footprint in its customer base. What those elements are and what the company must focus on to continue its growth are outlined in the following sections.

Looking at the Numbers

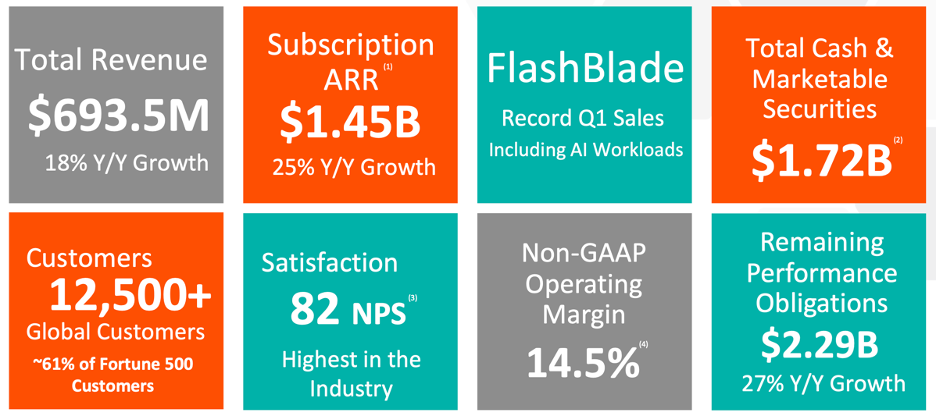

As mentioned, Pure had a strong first quarter of its fiscal year, showing overall revenue growth of 18% year over year and subscription services annual recurring revenue (ARR) growth of 25%.

While there are a lot of positives to point out for the company’s quarter, what stood out to me were the following:

- An increase of approximately 1,000 customers YoY, with a 3% increase in Fortune 500 customers.

- A record quarter for FlashBlade sales, showing a play for big AI workloads but also scaling down to support some of the “meat and potatoes” workloads such as backup.

- The focus that CEO Charlie Giancarlo put on the hyperscale market in his prepared remarks; clearly, the company sees a significant opportunity.

Equally important to what was achieved this quarter is the company’s outlook for Q2 and the longer term. In both cases, the forecast is strong. In fact, the company has issued guidance for FY2025 revenue of $3.1 billion, representing a 10.5% increase, with guidance that its Evergreen subscription-based storage is expected to grow by 50%.

This growth in Evergreen//One and Evergreen//Flex is important because it is really at the heart of Pure’s value proposition—delivering the cloud storage model to enterprise IT. The rapid adoption rate indicates that the company is aligned with the wants and needs of its customers and of enterprise IT in general.

AI Is Important to Pure’s Success—but Not the Only Reason for It

As with any tech company delivering public remarks these days, AI was at the core of Pure’s prepared statements for its investor call. This is understandable because financial analysts (which I’m not) are focused on how companies are approaching this high-growth, disruptive technology.

Pure cited three distinct opportunities in AI: high–performance data for GPU farms (e.g., CoreWeave, Lambda Labs), specialized storage for inference or RAG environments, and creating a centralized storage platform for easier AI access.

Each of these makes sense, and Pure has demonstrated its abilities in all of them. Critical to all of these usage scenarios is a fundamental attribute that Pure talks about constantly: simplicity. Put differently, Pure is removing the complexity associated with standing up storage environments that meet the needs of an enterprise beginning its AI journey. This goes beyond deploying performant hardware; pretty much any company can do that. This is about delivering point-and-click simplicity to deploy, provision, and manage the enterprise storage environment.

This need for simple goes beyond AI. It hits every facet of enterprise IT operations—from traditional business-critical workloads to containerized environments to hybrid cloud. Further, it will also apply to whatever disruptive technology comes next to replace AI in the tech hype cycle. (Trust me—it’s coming.) The consistent question is, does your storage environment enable the easy deployment and management of a given workload? Pure believes that FlashBlade consumed through Evergreen is the answer. And based on its growth rate, the company has good reason to be confident.

While embracing AI is critical to the success of Pure (and any storage company today), I don’t think it’s the only factor at work here. Reduction is the keyword for CIOs now—reduction in budget, reduction in IT operations overhead, reduction in complexity, reduction in carbon footprint. In other words: do more with less, and consume less energy while you’re at it. If a storage company can’t draw a direct line from its solutions to each of these initiatives, it will not find broad success in the enterprise.

What Are Pure’s Threats?

In my view, Pure will be insulated from any adverse macro conditions for as long as AI and the unprecedented growth in data creation continue to boom. It gets a little more interesting when we turn to Pure’s specific competitive position in its market niche. On that front, I believe Pure is well positioned in the enterprise. While much attention is focused on high-value companies including VAST Data, Weka, and the like, they simply don’t play in the space where Pure has established itself because these competitors focus on the highest end of the storage performance market.

Meanwhile, the enterprise vendors—NetApp, Dell, HPE, Lenovo, Pure, and a few others—will always actively challenge each other. With virtually every IT organization focused on modernization, adopting a cloud operating model is key to the “reduction” directive mentioned earlier. In response, we’ve seen these vendors continue to focus on delivering on this mandate.

Because only so much differentiation can be achieved through hardware design, the difference will be made in software, services, and consumption models. This is where Pure’s focus on making its offerings simple, consumable, and affordable should help it continue to gain market share. This is not to say that the folks at the other companies are underdelivering, but rather that these qualities are what Pure has built its business and brand around.

The data management and storage market is hot right now and will only get hotter as AI continues to grow. We’ll continue to check in on Pure and others in this space in upcoming quarters.