Intel’s fab division recently hosted its inaugural Direct Connect event in San Jose, California. The division, which just simplified its name from Intel Foundry Services to Intel Foundry, invited hundreds of press, analysts, and partners to hear about its vision for the future of the chip sector and the vital role that Intel Foundry intends to play in the industry’s success. Intel Foundry made some very bold claims at Direct Connect, but also showed that the company is on track to complete its ambitious “Five Nodes in Four Years” (5N4Y) turnaround strategy to get back to a competitive position in this market.

Intel’s Five Nodes in Four Years Promise

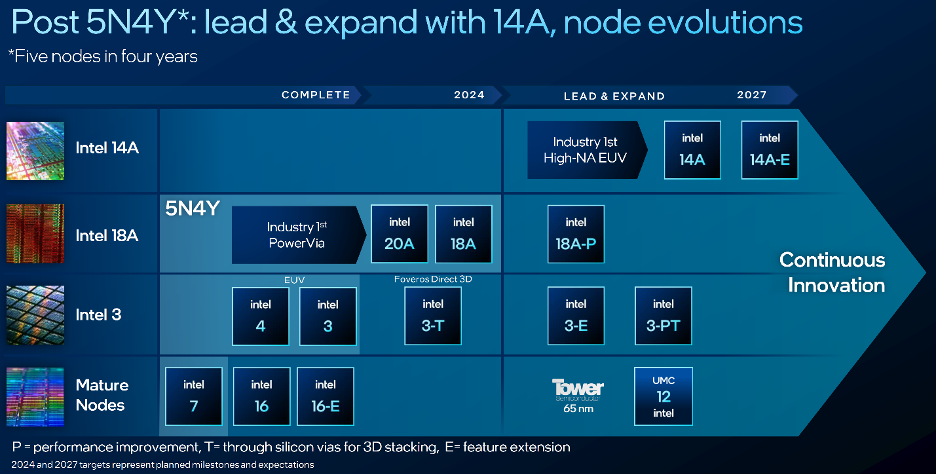

At the heart of the company’s return to relevance is its commitment to deliver five new chip production nodes in four years, which it says it should complete by the end of 2024 when it implements the Intel 18A process node. At Direct Connect, Intel also said that one of its 18A products, a Xeon processor codenamed Clearwater Forest, had already taped out, and that the next product is Panther Lake, an AI-heavy consumer CPU, which is expected in 2025. Clearwater Forest combines many of Intel’s innovations, including PowerVia, RibbonFET, EMIB, and Foveros Direct, and it utilizes an Intel 3 base die.

Going beyond 5N4Y, Intel has planned node extensions for Intel 18A and Intel 3, which come in the form of performance improvements (P), feature extensions (E), and through-silicon vias, or TSVs (T), which in Intel’s case are also known as Foveros 3D. Intel also shared its new plans for its 14A and 14A-E process nodes, the first high-NA (high numerical aperture) and EUV (extreme ultraviolet) nodes in the industry. This makes sense when you realize that Intel was ASML’s first customer to take delivery of its most advanced High-NA EUV system. Intel says that 14A will enter risk production in late 2026, and 14A-E will enter risk production in 2027. Intel also disclosed more detail around its 10A (1nm) process node, which should be in production starting in 2027.

A New Foundry

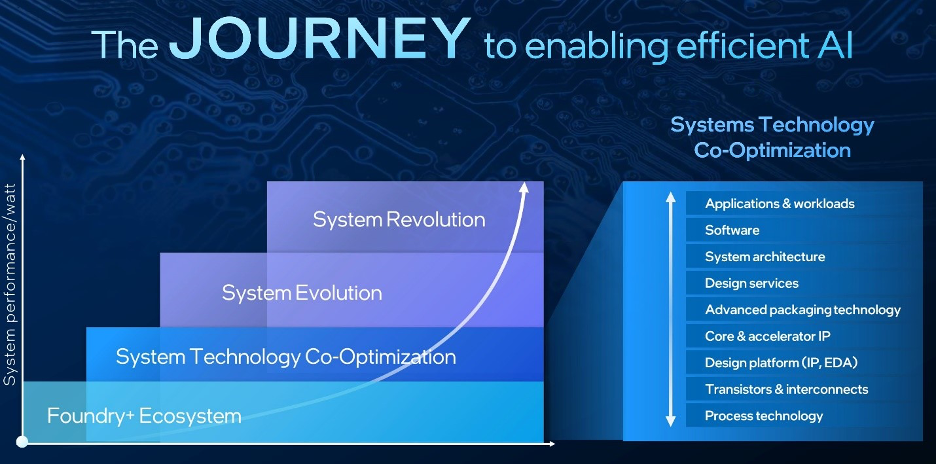

Intel Foundry wants to portray itself as more than just a foundry; it wants to be a complete systems foundry for the AI era. Intel is building its entire new-generation foundry approach around enabling AI, which explains why it invited Sam Altman, CEO of OpenAI, to talk with Pat Gelsinger at the end of the Direct Connect day. The company’s new tack is a far more vertical approach to chip manufacturing and takes it beyond being merely a wafer foundry, with Intel bringing in ecosystem partners to enable faster time to market and optimize production costs.

Customers and Growth

While foundries can’t always talk about who their customers are due to strict and deep NDAs, there are still some opportunities to talk about customer wins. At Direct Connect, the company touted $15 billion in “lifetime” revenues, which is $5 billion more than the figure it shared only a few weeks ago. Intel also announced that Microsoft is now a customer for its 18A process node. Intel even had Microsoft CEO Satya Nadella on stage via pre-recorded video to talk about the relationship and praise Intel Foundry. As Intel continues to grow its foundry business, it is expected to become the number-two foundry in the world by 2030. This implies unseating Samsung as the number-two foundry globally, but Intel doesn’t expect to surpass TSMC’s number-one status.

The Ecosystem

Intel Foundry must involve both IP and electronic design automation partners to be a successful foundry that can deliver on a system approach. To accomplish this, Intel has created the Intel Foundry Accelerator, consisting of most major EDA companies including Cadence, Synopsys, Ansys, Siemens, Keysight, and Lorentz Solution. Intel has also partnered with more than a dozen IP providers, including Arm, whose CEO, Rene Haas, came on stage to talk about the two companies’ partnership. This is a big deal because, for many years, Arm and Intel have been fierce competitors and continue to be so, especially in the datacenter and client-computing spaces. Having Arm on stage at an Intel event was a borderline when-pigs-fly moment for many in the industry who have seen these two companies go at it for so long.

Wrapping Up

Intel Foundry is building a firewall between itself and Intel Product. This is important for Intel Foundry’s business because it will very likely work with Intel Product’s competitors. This is similar to how Samsung’s many different component businesses and its foundry work with its competitors and put firewalls in place to protect highly confidential information. I believe that Intel splitting its business in two will eventually lead to a spinoff of the foundry unit as a semi-independent entity that can continue to attract outside investment and grow into a foundry that can compete with TSMC. Regardless, if Intel can complete its plan to deliver competitive process nodes, that will be a net positive for the whole industry as it will likely drive down prices and accelerate innovation through competition.

If Sam Altman wants enough foundry capacity to build all the AI chips he thinks will be necessary, then he should work to enable Intel Foundry’s success. While he didn’t make any commitments or allusions to working with Intel Foundry, I believe any chip company should absolutely shop around to all foundries before making any decisions. I believe that other factors such as Intel’s datacenter and AI performance are dragging down the stock price, and that once the product business can turn the corner in those segments, the stock will have an opportunity to rebound.