One of the perks of transitioning from executive roles to becoming an industry analyst is having the time to explore topics and companies more thoroughly—companies that I’ve previously dealt with at arm’s length. Take NetSuite, for example. I’ve known about it since its early days in the late 1990s, but now that it’s my advisory client, I have the opportunity to dive deep into its history. In this piece, I’ll provide some historical context for NetSuite, discuss its evolution before and after Oracle acquired it, and explore the advantages of its semi-independent status under the Oracle umbrella today.

The Early Years of ERP

The origins of enterprise resource planning (ERP) trace back to the early 1960s when IBM developed the first material requirements planning (MRP) system. MRP focused primarily on managing the procurement of materials through the delivery of finished products. As technology evolved, ERP systems expanded beyond MRP to encompass entire business operations, including accounting, HR, sales, compliance, reporting, and more.

Initially, most ERP and MRP systems were on-premises, but a significant shift occurred in the late 1990s as the industry began transitioning to cloud-based systems. This shift revolutionized ERP, giving rise to what we recognize today as modern ERP systems. Several companies pioneered this movement toward cloud-based systems, also known as software as a service (SaaS). NetSuite, founded in 1998, was one of the first to introduce a SaaS ERP solution, while Salesforce followed in 1999 with the first SaaS CRM. Concur also emerged as a pioneer by developing a SaaS expense management system.

Back when NetSuite began offering a cloud-only ERP system, I was working for an ERP provider focused on chemical distributors and manufacturers, with an on-premises solution that ran on the IBM RS/6000 UNIX server. NetSuite’s approach was groundbreaking compared to what the market was accustomed to, offering modern features that eventually surpassed its competitors.

NetSuite Pioneers Cloud ERP

NetSuite found its sweet spot by providing a comprehensive, scalable solution tailored to small and mid-sized businesses (SMBs), which often lacked the resources for expensive on-premises ERP systems. NetSuite’s SaaS model offered a cost-effective alternative, allowing businesses to grow without being constrained by traditional ERP limitations. To quickly build its customer base, I recall NetSuite initially offering user licenses at no charge for one to three years, generating revenue through implementation and support services. (I haven’t come across any official documentation of that approach yet, but I’ll keep digging and let you know what I find.) This strategy made it difficult for competitors such as the company I worked for to keep up. Despite efforts of competitors to highlight the potential long-term costs of NetSuite’s SaaS model, its approach proved highly effective, leading to rapid expansion. By the time Oracle acquired NetSuite in 2016 for $9.3 billion, the company had grown to serve over 11,000 organizations. Today, NetSuite has expanded its reach to more than 40,000 customers in 219 countries.

NetSuite’s Journey Through the Years

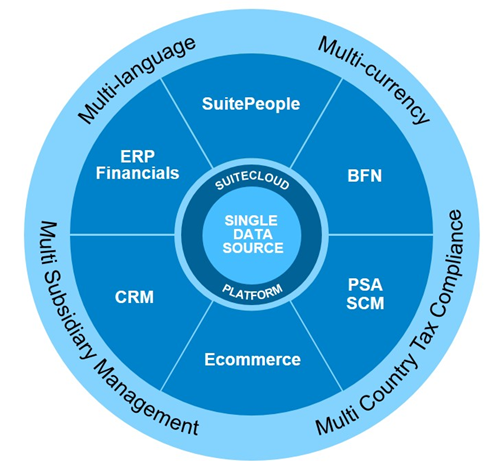

NetSuite’s comprehensive features have been pivotal in maintaining its leadership in the cloud ERP market. Launched with core accounting capabilities, NetSuite expanded over the years, for example by adding CRM functionality in 2002. The company went public in 2007 with a valuation of $1.55 billion. That same year, it introduced professional services automation (PSA), followed by the release of OneWorld in 2008 to support multi-company operations and the SuiteCloud customization platform in 2009. In 2012, NetSuite launched SuiteCommerce, an integrated e-commerce platform. The acquisition of TribeHR in 2013 brought is human capital management (HCM) capabilities. Manufacturing modules and supply chain functionality expanded in 2015 with the addition of a warehouse management system (WMS). NetSuite expanded its HCM capabilities with SuitePeople in 2017. In 2018, NetSuite further improved by incorporating AI-driven analytics for real-time decision-making.

Oracle’s interest in NetSuite dates all the way back to its inception; Oracle founder Larry Ellison was an early investor when the company was still known as NetLedger. The renaming to NetSuite in 2003 reflected its broader ambitions in the cloud ERP market. Oracle’s acquisition of NetSuite was likely part of a strategy to enhance its cloud offerings and compete more effectively with Salesforce. However, Oracle chose to let NetSuite operate independently, preserving its unique market position and distinct customer base.

NetSuite’s Strategic Advantages

NetSuite has maintained its market leadership by innovating through the rapid adoption of emerging technologies such as AI, IoT, and digital automation. NetSuite’s Supply 360 is an example of automation that optimizes supply chain processes by reducing manual tasks and enhancing efficiency. All of these improvements are more easily integrated into cloud-based systems than on-premises ones. On-premises ERP systems often have inflexible legacy architectures and lack regular updates, making the implementation of new technologies challenging. Another key strategic advantage of NetSuite is its accessibility through the cloud, which inherently removes the need for the additional infrastructure required by on-premises systems.

Oracle NetSuite’s “Built for NetSuite” (BFN) program assists developers in the SuiteCloud Developer Network (SDN) in building apps that integrate with the NetSuite platform. It ensures that these SuiteApps, which extend NetSuite’s capabilities, maintain the same quality as NetSuite’s native solutions. NetSuite also excels in offering customizable solutions, with tools like SuiteBuilder and the SuiteCloud Platform that allow administrators to tailor the system to specific business needs without requiring extensive coding. This flexibility is essential, as most enterprises need ERP customizations to meet their unique requirements. Additionally, NetSuite provides a comprehensive API catalog and the NetSuite Connector, enabling straightforward integration with e-commerce platforms, online marketplaces, and point-of-sale systems such as Shopify, BigCommerce, Adobe Commerce, WooCommerce, Amazon, eBay, and Walmart.

Customer-Centric Approach

NetSuite’s customer-centric approach is another factor that has contributed to its success. Although it doesn’t publish specific figures, it’s clear that NetSuite maintains a high customer retention rate, which is a testament to its reliability and the satisfaction of its users. This long-term retention is crucial in the SaaS industry, where customer loyalty translates to higher lifetime value per account.

Customers have gravitated to NetSuite in part because of its strengths across multiple industry verticals. Only 3% of companies use standard, out-of-the-box functionality for their ERPs, which ties to a strong preference for industry-specific solutions. NetSuite offers industry-specific solutions across sectors such as retail, manufacturing, education, and healthcare. One of its strongest verticals is the software and technology sector, where it serves 84 of the Forbes Cloud 100 companies.

Life Under the Oracle Brand

Under Oracle’s ownership, NetSuite has maintained the high level of service its customers expect. Although NetSuite is run as its own business unit, it has also benefited from Oracle’s extensive resources, which have fueled faster innovation and expansion, particularly in the SMB market. The acquisition allowed NetSuite to concentrate on its core strengths, such as serving mid-market companies, while leveraging Oracle’s cloud computing expertise to enhance its offerings. For example, NetSuite is able to leverage Oracle’s hardware and database technology in Oracle Cloud Infrastructure (OCI) datacenters, as well as the parent company’s AI capabilities.

There have been some mild downsides in recent years, including increased pricing and costs; this particularly applies to customizations and premium support, which can be burdensome for smaller businesses. Similar to most ERP systems, NetSuite can also introduce complexity for SMBs, often requiring specialized knowledge that their current staff may lack. This can make implementation more challenging, particularly if additional investment in training and expertise from Oracle is necessary.

NetSuite’s Implementation Model

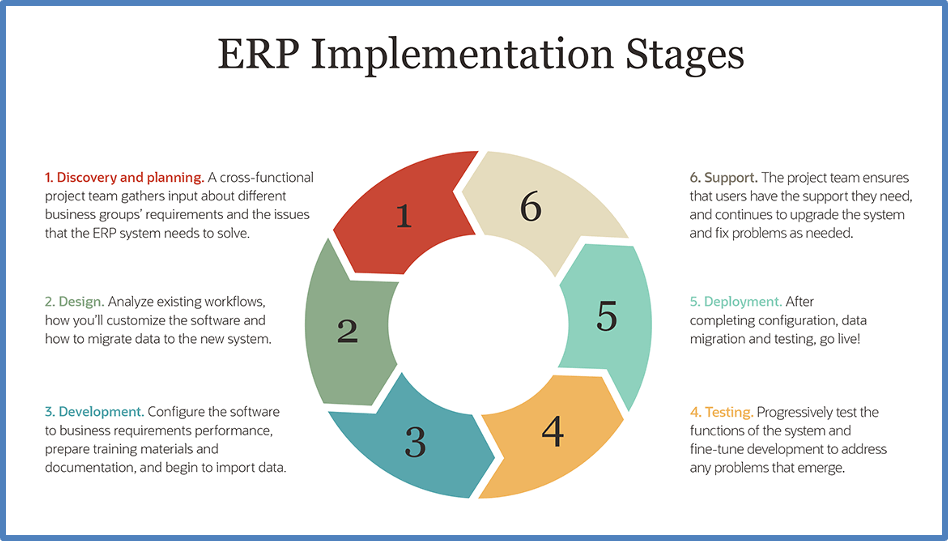

From my experience, properly managed ERP implementations are crucial to the long-term success of any enterprise. Along the way, effective data management strategies and change management processes are essential to achieving this success. NetSuite’s implementation model is designed to help businesses address the relevant issues quickly and efficiently. The process typically involves six stages:

- Discovery and Planning – This phase involves gathering information, understanding the customer’s business needs, and defining the project scope. Establishing transparent processes, roles, and responsibilities is critical at this stage.

- Design – During this phase, the system is reviewed to determine how it needs to be configured and whether any customizations are required to meet the customer’s specific needs. It’s essential to identify all business units that will be affected by the ERP system. NetSuite will manage and scope any necessary customizations.

- Development – System configurations, customizations, and data integrations are developed based on the design phase. Specific data is identified for migration, and training manuals are created. The project lead must ensure that all aspects defined in the design phase are developed as planned.

- Testing – This phase occurs before the system goes live. All modules, including customizations, NetSuite features, and migrated data, should be thoroughly tested to ensure they function as expected. All users must participate in testing to ensure they understand and accept the new system. I’ve observed that users may develop negative opinions about the system when they do not engage in this phase. Full user involvement ensures transparency and acceptance.

- Deployment – The system goes live in this phase, and users begin using it for day-to-day operations. Identifying and rectifying errors as quickly as possible with the help of NetSuite support or the customer’s administrative staff is essential.

- Support – This phase is vital for maintaining the effectiveness of the NetSuite system and includes staying current with the yearly updates that are part of the company’s support agreements. Ongoing support plays a crucial role in customer retention by ensuring that the system meets the customer’s evolving needs.

NetSuite Use Cases

NetSuite has impacted various industries. After implementing NetSuite, many enterprises report improved efficiency, productivity, cost control, decision-making, and competitiveness.

- Epec Engineered Technologies used NetSuite to enhance its operations by improving internal processes and developing both a product lifecycle management platform and an e-commerce platform. This allowed the company to double its transaction volume without increasing staff, demonstrating a marked improvement in efficiency and productivity.

- GoPro’s rapid growth overwhelmed its disjointed systems, leading to inefficiencies. GoPro implemented NetSuite, unifying its operations into one platform. GoPro reduced costs and order management response times 16-fold, managed its global supply network via a single system, and enhanced overall business performance.

- Naumi Hotels, a luxury boutique hotel group, enhanced its financial operations by implementing NetSuite. After adopting the platform, the company reduced the time needed to close financial reports by 66%. Additionally, auditing processes became 200% faster, improving the efficiency of internal controls and compliance.

- Action Health faced challenges due to limited access to critical information on its legacy on-premises system, making it difficult to evolve and grow. Without change, the company risked falling behind. Implementing NetSuite provided the visibility and data needed for better decision-making, helping Action Health identify opportunities for growth with key partners.

NetSuite’s Competitive Landscape

The cloud ERP market is highly competitive, with several key players striving to secure their market share. NetSuite competes with SAP, Microsoft Dynamics, Sage, Acumatica, Odoo, SYSPRO, Infor, QuickBooks, and its own parent company Oracle, each of which offers unique strengths. SAP is known for its deep functionality in enterprise-level ERP, catering to large corporations with complex needs. SAP’s Business One ERP solution is designed for SMBs, offering comprehensive tools to manage operations such as financials, sales, customer relationships, inventory, and production. Despite owning NetSuite, Oracle continues to provide its own ERP solutions, with particular strengths in database management and ERP for large enterprises. Microsoft Dynamics stands out for its seamless integration with other Microsoft products, making it a popular choice for businesses already invested in the Microsoft ecosystem.

Sage focuses on providing accessible ERP solutions for SMBs, emphasizing accounting. Acumatica offers flexible cloud ERP solutions with a pricing model that appeals to growing companies. Odoo, an open-source ERP, is known for its modularity and affordability, making it a viable option for smaller enterprises or those seeking customizable solutions. SYSPRO specializes in manufacturing and distribution, offering industry-specific ERP features. Infor provides cloud-based ERP solutions focusing on user experience and industry-specific customizations, particularly in healthcare and manufacturing. While traditionally an accounting software, QuickBooks has expanded into ERP functionalities for small businesses.

The Future of NetSuite

Over the past 25 years, I’ve marveled at NetSuite’s consistent growth—something I never would have imagined when I first encountered the company. NetSuite’s ability to adapt to market conditions and meet customer needs has been a key factor in its success.

For NetSuite to remain successful, ongoing innovation and staying ahead of emerging trends in the cloud ERP industry will be crucial. By continuing to integrate cutting-edge technologies, NetSuite will enhance its offerings, enabling its customers to operate more efficiently, adapt to changing demands, and maintain a competitive edge.

As more enterprise data moves from on-premises systems to the cloud and with the ERP market continuing to grow, we can expect an even more significant shift toward cloud-based solutions. NetSuite is well-positioned to capture a substantial share of the expanding cloud ERP market, which is projected to reach $239 billion by 2032. This shift shows the increasing demand for flexible and scalable ERP systems, making cloud-based solutions such as NetSuite an attractive and cost-effective choice for companies of all sizes, not just SMBs.